Loading

Get Irs 1040 - Schedule E 2018

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule E online

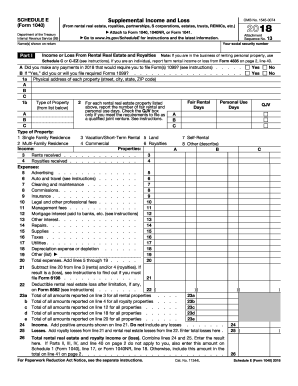

Filling out the IRS 1040 - Schedule E is an essential step for individuals reporting supplemental income or loss from rental real estate, royalties, partnerships, and S corporations. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete your IRS 1040 - Schedule E online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your name(s) and social security number at the top of the form. Ensure that this information matches the details on your main tax return.

- In Part I, indicate whether you made any payments in 2018 that would require filing Form(s) 1099. Select 'Yes' or 'No' as appropriate.

- For each rental property, input the physical address, type of property, and the number of fair rental days and personal use days you experienced.

- Report the income received from rental properties in the indicated fields. This includes rents and royalties received.

- List all applicable expenses related to your rental properties, such as advertising, maintenance, and utility costs. This will be critical for calculating your overall profit or loss.

- Sum your total expenses and deduct this amount from your total rental income to determine your net income or loss.

- Complete Parts II, III, and IV if applicable, providing information regarding partnerships, S corporations, or estates.

- After ensuring all information is accurate, you can save your changes, download a copy of the completed form, print it, or share it as necessary.

Start completing your IRS 1040 - Schedule E online today for simplified filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Not everyone needs a Schedule E tax form. This form is exclusively required for individuals with rental income or certain partnership interests. If you do not have these income sources, you won’t need to file IRS 1040 - Schedule E. However, if your situation changes, you might find it necessary in the future.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.