Loading

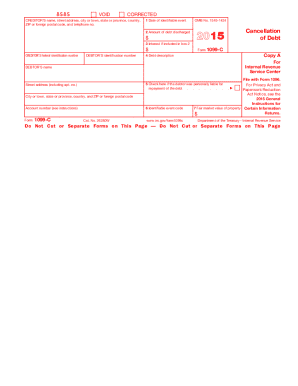

Get Irs 1099-c 2015

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-C online

The IRS 1099-C form is used to report the cancellation of debt. Filling it out accurately is important for compliance with tax regulations. This guide will provide you with step-by-step instructions to help you complete the form online.

Follow the steps to fill out the IRS 1099-C with ease.

- Press the ‘Get Form’ button to access the IRS 1099-C and open it in the editor.

- Fill in the creditor's name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone number in the designated fields.

- Enter the date of the identifiable event in Box 1. This date represents when the earliest recognizable event occurred or the discharge date.

- Input the amount of debt discharged in Box 2. If you disagree with this amount, reach out to the creditor for clarification.

- If applicable, enter the interest amount included in the debt in Box 3.

- Provide a description of the debt in Box 4 as required.

- Indicate whether the debtor was personally liable for the repayment of the debt in Box 5 by checking the appropriate box.

- Fill in the identifiable event code in Box 6, referring to the details specified in IRS Publication 4681.

- If applicable, enter the fair market value of the property in Box 7, especially if it pertains to foreclosure or abandonment.

- Review all entries for accuracy, save your changes, and then download, print, or share the completed form as necessary.

Complete your IRS 1099-C form online to ensure compliance and accuracy.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Receiving an IRS 1099-C indicates that the creditor has forgiven a portion of your debt, but this does not always absolve you of all obligations. It's important to verify whether the debt is fully discharged or if you owe any remaining balance. For a clear understanding of your obligations, consider using US Legal Forms as a resource to explore your options.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.