Get Irs Instruction 1065 - Schedule K-1 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1065 - Schedule K-1 online

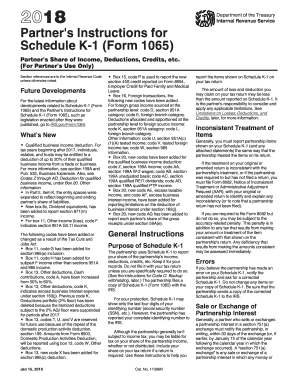

Filling out the IRS Instruction 1065 - Schedule K-1 online can seem daunting, but understanding its components and how to complete each section will simplify the process. This guide will provide step-by-step instructions to help you accurately complete the form.

Follow the steps to successfully complete your Schedule K-1 online.

- Press the ‘Get Form’ button to access the Schedule K-1 form online and open it in the editor.

- In Part I, provide the required information about the partnership, including its name, address, and employer identification number (EIN). Ensure all details are accurate and up to date.

- In Part II, fill in your personal information as the partner, including your name, address, and taxpayer identification number. It is crucial to verify that this information matches what the IRS has on file.

- In Part III, report your share of the partnership's income, deductions, credits, and other items in accordance with the instructions provided for each box, making sure to reference the codes provided for specific information.

- Double-check each entry against the partnership's records to ensure accuracy. Make sure to consider any limitations that may apply to your specific situation.

- Once you have completed the form, review it carefully for any errors. After making any necessary corrections, you can save your changes, download, print, or share the completed form as needed.

Start filling out your IRS Schedule K-1 online today to ensure accurate and timely reporting.

Get form

Schedule K Form 1065 includes information about the partnership's income, deductions, credits, and other items. Partners will find details on separately stated items that they need to report on their tax returns. It is crucial to complete this form accurately to comply with IRS Instruction 1065 - Schedule K-1. For a seamless experience, consider utilizing uslegalforms, which can assist with the process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.