Loading

Get Dol Cc-257

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DoL CC-257 online

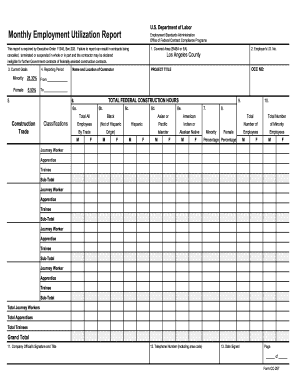

The DoL CC-257 form is an essential document that reports employment utilization for contractors under federal contracts. This guide provides clear, step-by-step instructions for completing the form correctly and efficiently online.

Follow the steps to successfully fill out the DoL CC-257 online

- Press the ‘Get Form’ button to access the DoL CC-257 form and open it in your preferred online editing tool.

- Begin with Section 1, 'Covered Area.' Here, enter the relevant geographical area as indicated in the contract notification.

- In Section 2, provide your employer's identification number. This should be your Federal Social Security Number that you use for Employer's Quarterly Federal Tax Return.

- Next, in Section 3, enter the current goals, including minority and female employment targets based on your contract.

- For Section 4, record the reporting period. This is usually monthly or as defined by the compliance agency, beginning with the effective date of the contract.

- In Section 5, identify the construction trades your company is engaged in for this reporting period.

- Move to Section 6, where you will fill out the details about work-hours of employment. Provide the total worked hours by each employee classification for males and females.

- In Section 7, calculate and report the minority percentage based on the hours reported in Section 6.

- For Section 8, report the female percentage similarly based on the data entered in Section 6.

- Proceed to Sections 9 and 10 to report the total number of employees and minority employees in each classification of each trade.

- In Section 11, provide the signature and title of a company official who is responsible for the accuracy of the report.

- Enter the telephone number of the official in Section 12, including the area code.

- Finally, fill in the date when the form is signed in Section 13.

- Once all fields are completed, review the form for accuracy, and then save changes. You can choose to download, print, or share the completed form as needed.

Complete your DoL CC-257 form online today to ensure compliance and support federal contracting requirements.

Related links form

Employers typically require the W-4 form to determine your withholding allowance. This form helps specify the number of allowances you are claiming, guiding tax withholding for your paycheck. Be sure to reference the DoL CC-257 during this process for the most compliant and effective reporting. If you need further assistance, UsLegalForms can provide the necessary forms and instructions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.