Loading

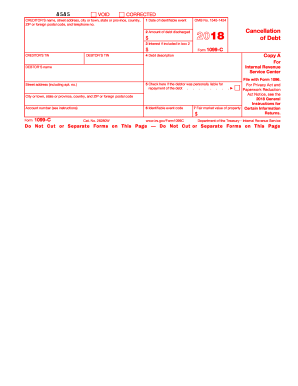

Get Irs 1099-c 2018

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-C online

Filling out the IRS 1099-C form is an essential process for reporting the cancellation of debt. This guide provides clear, step-by-step instructions to help users complete the form accurately online, ensuring compliance with IRS regulations.

Follow the steps to complete your IRS 1099-C online.

- Click 'Get Form' button to download the 1099-C form. This opens the document for you to begin filling it out.

- Enter the creditor's name, address, and telephone number in the designated fields at the top of the form. Ensure all details are accurate.

- In Box 1, input the date of the identifiable event that led to the cancellation of debt. This date marks the occurrence of the event.

- In Box 2, report the total amount of debt that has been discharged. This should reflect the actual amount forgiven by the creditor.

- If applicable, enter any interest amount included in the debt in Box 3. This may need reporting as part of your gross income.

- Provide a description of the debt in Box 4. This description should be clear to reflect the nature of the canceled debt.

- If the debtor was personally liable for repaying the debt, check the box in Box 5. This indicates personal responsibility.

- In Box 6, input the identifiable event code related to the cancellation of debt. Use the guide provided by IRS for the appropriate code.

- If applicable, indicate the fair market value of the property related to the debt in Box 7 if there was a foreclosure or abandonment. This value is important for tax considerations.

- Review all entries for accuracy. Once complete, you can save changes, download the filled form, print it, or share it as necessary.

Start filling out your IRS 1099-C form online today to ensure you're compliant with tax reporting requirements.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To report your IRS 1099-C on your tax return, include the canceled debt amount on Schedule 1 of Form 1040. After entering the information, transfer the amount to your main tax form. This process ensures that you accurately reflect any income from canceled debt, helping you avoid any future IRS issues.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.