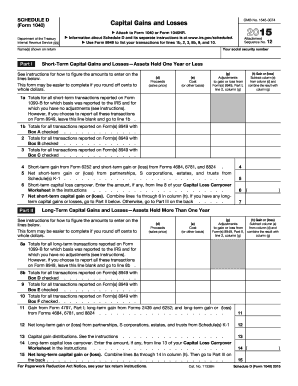

Get Irs 1040 - Schedule D 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1040 - Schedule D online

How to fill out and sign IRS 1040 - Schedule D online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When the tax period commenced unexpectedly or you simply overlooked it, it could likely lead to difficulties for you.

IRS 1040 - Schedule D is not the easiest one, but you have no cause for alarm in any situation.

With our comprehensive digital solution and its professional tools, completing IRS 1040 - Schedule D becomes more convenient. Don’t hesitate to try it out and spend more time on leisure activities rather than on file preparation.

- Access the document in our sophisticated PDF editor.

- Input the necessary information in IRS 1040 - Schedule D, utilizing fillable fields.

- Insert images, crosses, check marks, and text boxes, if needed.

- Repeating fields will be automatically populated after the initial entry.

- If you encounter any issues, activate the Wizard Tool. You will receive some advice for much simpler submission.

- Always remember to include the date of application.

- Create your distinctive e-signature once and place it in all required locations.

- Review the information you have provided. Rectify errors if necessary.

- Click on Done to complete modifications and select how you intend to submit it. You can use digital fax, USPS, or email.

- You may also download the file to print it later or upload it to cloud storage.

How to modify Get IRS 1040 - Schedule D 2015: personalize forms online

Experience a stress-free and digital approach to managing Get IRS 1040 - Schedule D 2015. Utilize our dependable online service and conserve a significant amount of time.

Creating every document, including Get IRS 1040 - Schedule D 2015, from the ground up consumes excessive time, so having a reliable platform of pre-prepared document templates can tremendously enhance your efficiency.

However, utilizing them can pose challenges, particularly with PDF files. Luckily, our vast library features an integrated editor that allows you to effortlessly fill out and modify Get IRS 1040 - Schedule D 2015 without leaving our site, ensuring you don’t waste your valuable time managing your forms. Here’s what you can do with your document using our service:

Whether you need to fill out an editable Get IRS 1040 - Schedule D 2015 or any other template offered in our inventory, you’re well-equipped with our online document editor. It’s straightforward and secure, requiring no special expertise.

Our web-based tool is designed to accommodate virtually everything you can imagine regarding file editing and execution. Stop relying on outdated methods for handling your documents. Opt for a professional solution to optimize your processes and reduce dependency on paper.

- Step 1. Locate the necessary document on our site.

- Step 2. Click Get Form to access it in the editor.

- Step 3. Utilize professional editing tools to insert, delete, annotate, and highlight or obscure text.

- Step 4. Create and append a legally-recognized signature to your document by using the sign option from the top toolbar.

- Step 5. If the template’s layout isn’t to your liking, employ the tools on the right to eliminate, add, and rearrange pages.

- Step 6. Integrate fillable fields so other individuals can be invited to complete the template (if necessary).

- Step 7. Distribute or send the document, print it, or select the format in which you would like to receive the file.

Get form

Related links form

The $3000 capital loss rule allows taxpayers to deduct up to $3000 of capital losses from their ordinary income on IRS 1040 - Schedule D. If your total capital losses exceed your total capital gains, you can use this deduction to offset taxable income, which can lead to a lower overall tax bill. It’s an important strategy for managing investment losses.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.