Loading

Get Irs 1040 - Schedule C 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

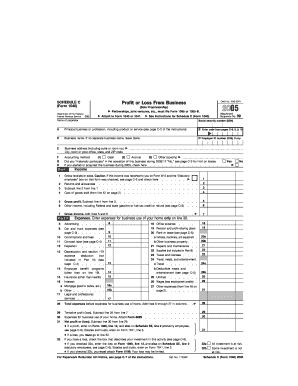

How to fill out the IRS 1040 - Schedule C online

Filling out the IRS 1040 - Schedule C can seem daunting, but with the right guidance, you can complete this essential form with confidence. This guide will walk you through each section of the form step by step, ensuring you understand what is required and how to accurately report your business income and expenses.

Follow the steps to accurately complete the IRS 1040 - Schedule C.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name as the proprietor in the designated field and provide your social security number (SSN). Be sure to also include the principal business or profession along with a brief description of your product or service.

- If applicable, provide your Employer Identification Number (EIN) and indicate your accounting method by selecting cash, accrual, or other.

- Indicate whether you materially participated in the business during the tax year. If you are new to the business, check the box to confirm.

- In Part I, report your income by entering gross receipts or sales on line 1. If you have returns and allowances, enter that amount on line 2 and calculate your gross profit on line 3.

- Continue by calculating the cost of goods sold, entering this value on line 4, and determining your gross income on line 7 by adding lines 5 and 6.

- In Part II, record your business expenses on the appropriate lines. Make sure to include any costs for advertising, office expenses, car and truck expenses, and other various expenditures relevant to your business.

- Add all your expenses together to find the total. Enter this total to determine your tentative profit or loss on line 29 by subtracting total expenses from gross income.

- If applicable, enter expenses for the business use of your home on line 30, completing that section as required.

- Calculate your final net profit or loss by subtracting line 30 from line 29. Follow the instructions provided for reporting this value on the main Form 1040.

- Finally, save your changes, and you can choose to download, print, or share your completed form for submission as necessary.

Complete your IRS 1040 - Schedule C online today to ensure your business income is accurately reported.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Certain factors can trigger an IRS audit on IRS 1040 - Schedule C filings, including significant discrepancies between your reported income and expenses. Unusually high deductions compared to your income may raise red flags. Maintaining organized records and justifiable expenses can help reduce your chances of an audit.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.