Loading

Get Irs 1095-c 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1095-C online

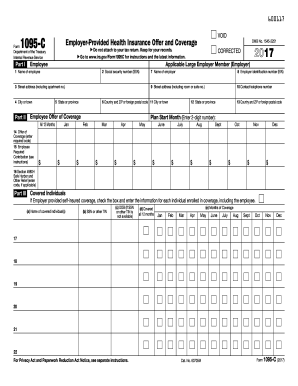

Filling out the IRS 1095-C form can seem daunting, but with clear instructions, you can navigate the process smoothly. This guide provides step-by-step details on how to complete the form correctly and efficiently online.

Follow the steps to complete the IRS 1095-C form online.

- Click 'Get Form' button to obtain the IRS 1095-C form and open it in your chosen editing interface.

- Begin filling out Part I with your personal information. Enter your name, social security number (SSN), and address, ensuring all details are accurate.

- In Part II, provide your employer's information, including their name, employer identification number (EIN), and contact details. Complete the Offer of Coverage section by entering the required codes that describe the coverage options available to you.

- In line 15 of Part II, enter your employee required contribution for the lowest-cost self-only coverage that your employer offered, if applicable.

- Proceed to Part III to list the covered individuals, including their names, social security numbers (or TINs), and their dates of birth if necessary. Indicate whether each individual was covered all 12 months and specify the months they were covered.

- Review all the entries to ensure that the information is complete and correct. It is important that all data is accurate before finalizing the document.

- Once you have verified that all information is accurate, save the changes you made to the form. You can also download it for your records, print it out, or share it as necessary.

Complete your IRS 1095-C form online today for efficient tax documentation.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To obtain your IRS 1095-C form online, start by checking with your employer if they offer electronic access to the document. Many employers provide a secure portal where you can download your form directly. Make sure you have your login credentials ready for quick access. If not available online, you may need to request it directly from your employer.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.