Loading

Get Ak Dor 661 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK DoR 661 online

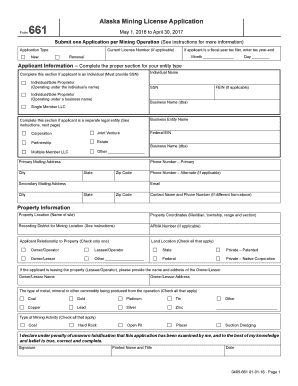

This guide provides detailed instructions for users on how to complete the AK DoR 661 form for the Alaska Mining License Application. By following these steps, you can navigate the application process smoothly and efficiently.

Follow the steps to successfully fill out the AK DoR 661 online.

- Click the ‘Get Form’ button to access the application form and open it in the online editor.

- Begin by selecting the application type. Indicate whether you are applying for a new license or a renewal by checking the appropriate box.

- In the applicant information section, complete the relevant fields according to your entity type. If you are an individual or sole proprietor, provide your Social Security Number (SSN). If you are representing a business entity, enter the business name and Federal Employer Identification Number (EIN).

- Fill out the primary and secondary mailing addresses, along with your primary phone number and email address.

- Provide the property information, including the property location, coordinates, recording district, and any applicable APMA number.

- Indicate your relationship to the property by selecting the appropriate checkbox (Owner/Operator, Lessee/Operator, etc.). If applicable, provide the name and address of the owner or lessor.

- Select the type of metal, mineral, or commodity produced from the operation by checking all that apply.

- Indicate the type of mining activity you will be conducting by checking all appropriate categories.

- Finally, declare the truthfulness of your application by signing, printing your name and title, and dating the form.

- Once you have completed the form, you can save your changes, download, print, or share the form as needed.

Take the first step towards obtaining your mining license by completing the AK DoR 661 online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The AK 1 form is used to report income from sources other than wages, such as dividends, interest, or retirement distributions. This form plays a vital role in determining your overall tax liability in Alaska. Always refer to AK DoR 661 for the latest filing instructions and compliance requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.