Loading

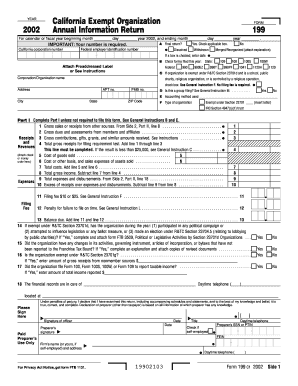

Get Ca Ftb 199 2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 199 online

Filling out the CA FTB 199 form online can streamline the process for exempt organizations providing required annual information to the Franchise Tax Board. This guide offers clear, step-by-step instructions tailored to users, regardless of their legal experience.

Follow the steps to complete the CA FTB 199 online.

- Press the ‘Get Form’ button to access the online version of the CA FTB 199 form and open it in the relevant online editor.

- Begin by entering the year for which you are filing the form. Specify whether the form is for a calendar year or fiscal year, filling in the appropriate start and end dates.

- Indicate if your organization was dissolved, withdrawn, or merged/reorganized by checking the applicable box. If so, enter the relevant date.

- Provide the California corporation number and, if applicable, the federal employer identification number (FEIN) in the designated fields.

- Input the organization’s name and address, ensuring all details are accurate. Include apartment or private mailbox numbers as necessary.

- Address whether the filing is a group return, checking ‘Yes’ or ‘No’ as applicable.

- List the accounting method used, ensuring alignment with organizational practices.

- Complete Part I by entering gross sales or receipts, gross dues and assessments, and gross contributions received in the corresponding fields, ensuring accuracy for all reported amounts.

- Calculate total gross receipts by summing the inputs from Part I, and ensure all amounts are reported correctly according to the provided guidance.

- Continue through the form, addressing all required sections such as total expenses and reporting any political or legislative activities if applicable.

- Review the entire form for accuracy before proceeding. Use the save option to maintain your progress; you can also download, print, or share the completed document as needed.

Complete your CA FTB 199 form online today to ensure timely submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Certain individuals may be exempt from filing taxes in California, such as those whose income falls below the state's minimum threshold. Additionally, some retirees and individuals receiving specific government benefits may qualify for exemption. If you’re uncertain about your status, consider consulting the California FTB or using a platform like uslegalforms to understand your situation better.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.