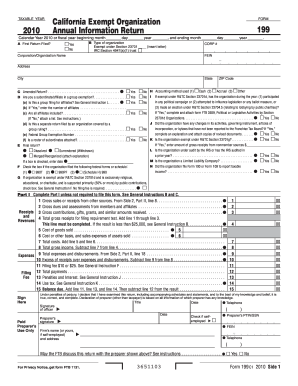

Get Ca Ftb 199 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CA FTB 199 online

How to fill out and sign CA FTB 199 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the filing period began suddenly or perhaps you simply overlooked it, it might lead to complications for you. CA FTB 199 is not the simplest form, but there’s really no need to fret regardless.

With our robust online application, you'll grasp how to complete CA FTB 199 in times of urgent time scarcity. All you have to do is adhere to these straightforward guidelines:

With this thorough digital solution and its effective tools, submitting CA FTB 199 becomes more convenient. Don’t hesitate to give it a try and invest more time in your interests instead of preparing documentation.

- Open the file using our robust PDF editor.

- Complete the necessary information in CA FTB 199, making use of the fillable fields.

- Add images, marks, checkboxes, and text areas, if needed.

- Repeated information will be auto-filled after the initial entry.

- In case of difficulties, activate the Wizard Tool. You will receive helpful hints for easier completion.

- Don't forget to input the application date.

- Create your unique electronic signature once and place it in all the required areas.

- Review the information you've entered. Fix errors if necessary.

- Click Done to finalize your edits and choose how you wish to submit it. You will have the option to use virtual fax, USPS, or email.

- You can download the document for later printing or upload it to cloud services like Google Drive, OneDrive, etc.

How to modify Get CA FTB 199 2010: personalize forms online

Place the appropriate document management tools at your disposal. Complete Get CA FTB 199 2010 with our dependable solution that comes equipped with editing and eSignature capabilities.

If you wish to execute and validate Get CA FTB 199 2010 online effortlessly, then our online cloud-based platform is the perfect solution. We offer a rich template-based catalog of ready-to-use forms you can modify and finalize online.

Furthermore, there’s no need to print the document or rely on external options to make it fillable. All necessary features will be readily accessible for your use as soon as you open the file in the editor.

In addition to the aforementioned functionalities, you can protect your file with a password, include a watermark, convert the file to the required format, and so much more.

Our editor makes editing and authenticating the Get CA FTB 199 2010 straightforward. It empowers you to perform nearly everything when handling documents.

Moreover, we consistently ensure that your document editing experience is safe and adheres to key regulatory standards. All these factors make using our tool even more enjoyable. Obtain Get CA FTB 199 2010, make the necessary edits and updates, and receive it in the required file format. Try it out today!

- Alter and mark up the template

- The top toolbar includes features that assist you in emphasizing and redacting text, excluding images and graphics (lines, arrows, checkmarks, etc.), sign, initialize, and date the form, among others.

- Arrange your documents

- Utilize the left toolbar if you want to rearrange the form and/or delete pages.

- Prepare them for dissemination

- If you intend to make the document fillable for others and share it, you can utilize the tools on the right to add various fillable fields, signature, date, text box, etc.

Get form

You should mail your California form 199 to the address specified in the instructions provided by the Franchise Tax Board. The mailing address may vary based on whether you are enclosing a payment or filing a return. To avoid any delays, double-check the latest information on the official FTB website or use uslegalforms for accurate addressing and filing guidance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.