Loading

Get Ca Ftb 199 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 199 online

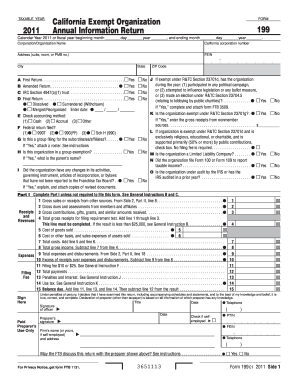

The CA FTB 199 is the California Exempt Organization Annual Information Return. This guide provides clear and detailed instructions for users to complete this form online with ease, ensuring compliance with state tax regulations.

Follow the steps to complete your CA FTB 199 online.

- Click the ‘Get Form’ button to access the CA FTB 199 form. This action will allow you to download and open the form in a suitable editor for completion.

- Begin by entering the organization's official name, California corporation number, address, and Federal Employer Identification Number (FEIN) in the designated fields to ensure accurate identification.

- Check the appropriate boxes for the return type. Indicate if this is the first return, an amended return, or a final return, along with any relevant exemptions related to the organization’s status.

- Provide information about the organization's accounting method by selecting either cash, accrual, or other. Please enter the gross receipts from non-member sources if applicable.

- In Part I, complete the required lines for gross sales, dues, contributions, and total gross receipts to determine filing requirements. Ensure that the receipts total is completed.

- Complete Part II if the organization has gross receipts exceeding $25,000. Fill in the details regarding income types and various expense categories accordingly.

- Fill out the Schedule L to provide a balance sheet for the beginning and end of the taxable year, detailing all assets and liabilities accurately.

- After filling out all sections, review the entire form for completeness. You may now proceed to save changes to the form, download it for future reference, or print it for submission.

- Finally, ensure that the form is signed and dated where required, confirming that all information is true and accurate to the best of your knowledge.

Start completing your CA FTB 199 online today to ensure your organization remains compliant with state regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, if you are a nonresident who has received income from California sources, you are required to file a California nonresident tax return. Filing helps you report your California income correctly and ensures compliance with CA FTB regulations. If you're unsure about your requirements, consider using the uslegalforms platform, which provides helpful guidance on filing.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.