Get De Dor 200-c 2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DE DoR 200-C online

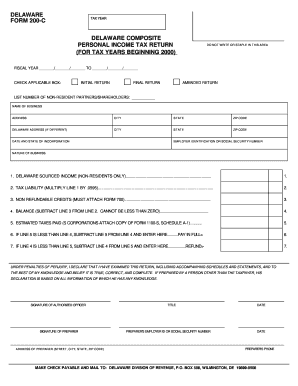

Filling out the Delaware Composite Personal Income Tax Return (DE DoR 200-C) online can simplify the tax submission process for non-resident partners and shareholders. This guide will provide a comprehensive walkthrough of each section of the form to ensure accurate and efficient submission.

Follow the steps to complete your form online

- Click the ‘Get Form’ button to obtain the DE DoR 200-C and open it in the online editor.

- In the section labeled 'Fiscal Year,' input the applicable start and end dates for the tax year.

- Check the appropriate box indicating whether this is an initial return, a final return, or an amended return.

- List the total number of non-resident partners or shareholders in the specified field.

- Fill in the business name, address, city, state, and zip code of the entity filing the return. If the Delaware address is different, provide that information as well.

- Indicate the date and state of incorporation, followed by the employer identification number or social security number of the business.

- Describe the nature of the business in the provided section.

- For line 1, enter the total Delaware-sourced income for non-residents.

- Calculate the tax liability by multiplying the amount from line 1 by 0.0595, and enter that amount on line 2.

- If applicable, report any non-refundable credits, ensuring to attach Form 700 as required; enter the total on line 3.

- Subtract line 3 from line 2 to determine the balance, and record that on line 4. Remember, this cannot be less than zero.

- If estimated taxes have been paid, indicate that total on line 5, ensuring S corporations attach the relevant Form 1100-S, Schedule A-1.

- If line 5 is less than line 4, subtract line 5 from line 4 and enter the result on line 6 for payment due. Conversely, if line 4 is less than line 5, subtract line 4 from line 5 and report the refund on line 7.

- The form must be signed by an authorized officer and the preparer. Fill in all applicable fields for names, titles, and contact information.

- Once all information is complete, save your changes. You can then download, print, or share the form as needed.

Complete your DE DoR 200-C form online today for a seamless tax submission experience.

Get form

Related links form

Delaware is often considered a tax-friendly state for retirees due to its lack of sales tax and low property tax rates. Additionally, Social Security benefits are exempt from state taxes, which can significantly enhance retirement income. However, there are some taxes applicable to pension income and interest, so retirees should evaluate their specific financial situation. By utilizing resources such as the DE DoR 200-C and platforms like uslegalforms, retirees can maximize their tax benefits while navigating Delaware's tax landscape.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.