Get Pr Sc 2745 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

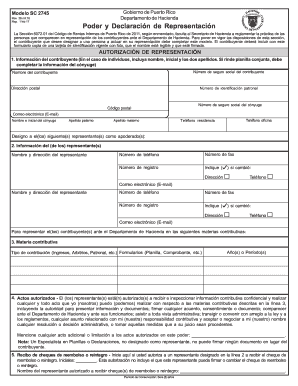

Tips on how to fill out, edit and sign PR SC 2745 online

How to fill out and sign PR SC 2745 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Filling out tax forms can evolve into a significant issue and considerable frustration if proper guidance isn't provided.

US Legal Forms has been created as an online solution for PR SC 2745 electronic submission and offers several benefits for the taxpayers.

Click the Done button in the top menu once you have finished it. Save, download, or export the completed form. Use US Legal Forms to ensure secure and straightforward completion of the PR SC 2745.

- Locate the form on the website within the designated section or through the search engine.

- Click the orange button to access it and wait for it to load.

- Examine the form and pay close attention to the instructions. If you have never completed the sample before, follow the step-by-step directions.

- Focus on the highlighted fields. These are fillable and require specific information to be entered. If you are unsure about what to provide, refer to the instructions.

- Always sign the PR SC 2745. Utilize the built-in tool to create the electronic signature.

- Select the date field to automatically insert the current date.

- Review the document to make changes and adjustments before the submission.

How to modify Get PR SC 2745 2017: personalize forms online

Your quickly adjustable and tailor-made Get PR SC 2745 2017 template is readily accessible. Capitalize on our assortment with an integrated online editor.

Do you delay finishing Get PR SC 2745 2017 because you simply don't know where to begin and how to proceed? We empathize with your situation and present you with an excellent tool that has nothing to do with battling your procrastination!

Our online library of ready-made templates allows you to sift through and select from countless fillable forms designed for various purposes and situations. However, acquiring the document is merely scratching the surface. We provide you with all the necessary tools to complete, validate, and alter the template of your preference without exiting our site.

All you need to do is access the template in the editor. Review the wording of Get PR SC 2745 2017 and confirm whether it's what you’re looking for. Start filling out the template by utilizing the annotation tools to give your form a more structured and tidier appearance.

In summary, along with Get PR SC 2745 2017, you'll receive:

With our fully-equipped option, your completed forms are perpetually legally binding and completely encrypted. We ensure the protection of your most sensitive information.

Acquire what is necessary to create a professionally-looking Get PR SC 2745 2017. Make the optimal choice and try our platform now!

- Insert checkmarks, circles, arrows, and lines.

- Highlight, obscure, and amend the existing text.

- If the template is intended for additional users as well, you can incorporate fillable fields and share them for others to complete.

- Once you’re finished with the template, you can obtain the document in any available format or select any sharing or delivery options.

- A comprehensive set of editing and annotation tools.

- An integrated legally-binding eSignature feature.

- The ability to create forms from scratch or based on the previously uploaded template.

- Compatibility with various platforms and devices for enhanced convenience.

- Numerous options for protecting your files.

- A variety of delivery options for easier sharing and dispatching documents.

- Adherence to eSignature regulations governing the use of eSignatures in electronic transactions.

Individuals and businesses may qualify for Puerto Rico tax exemptions based on residency status and specific activities within the territory. To benefit from these exemptions under PR SC 2745, you need to meet certain requirements, such as being a bona fide resident or operating a qualifying business. It's wise to review the criteria with a tax expert to fully leverage these opportunities.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.