Loading

Get Pr Sc 2745 2003

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR SC 2745 online

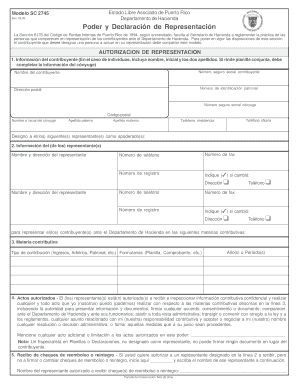

This guide provides clear and concise instructions for completing the PR SC 2745 form online. It is essential for users to accurately fill out this document to authorize representation before the Departamento de Hacienda.

Follow the steps to successfully complete your form.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the contributor's information in the relevant fields. This includes full name, social security number, and postal address. If filing jointly, include the spouse's details.

- Provide details for the representative(s) you wish to designate. Fill in the name, address, and contact information for each representative.

- Describe the tax matters for which the representative is authorized. Specify the types of contributions and relevant years or periods in the designated section.

- Indicate any additional acts authorized for the representatives to perform on your behalf concerning the stated tax matters.

- If you want to authorize your representative to receive refunds, provide their name in the relevant section.

- Choose your preferences for notifications and communications regarding official correspondence.

- If there are any revocations of prior authorizations, indicate this in the appropriate section.

- Complete the signature section. If filing jointly, both individuals must sign. Ensure that the form is dated.

- Finally, review all entered information for accuracy. Once confirmed, you can save changes, download, print, or share the completed form.

Complete your PR SC 2745 form online today to ensure proper representation.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

US permanent residents are generally required to file taxes on their worldwide income, similar to citizens. This obligation holds true even if they live outside the United States or Puerto Rico. Understanding your tax responsibilities can be complex, and using resources like PR SC 2745 can help clarify your filing needs.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.