Loading

Get Pr Sc 2645 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR SC 2645 online

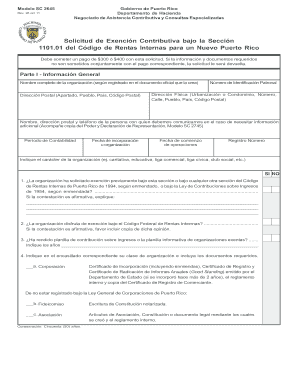

Filling out the PR SC 2645 form is a crucial step for organizations seeking tax exemption under the Puerto Rico Internal Revenue Code. This guide will walk you through each section of the form to ensure a smooth online submission process.

Follow the steps to complete your application accurately.

- Click ‘Get Form’ button to access the PR SC 2645 form and open it in an online editor.

- In Part I, provide the full name of your organization exactly as it appears on official documentation, along with the postal address, employer identification number, and physical address.

- Fill out the contact information for a representative, including their name, postal address, and phone number, to facilitate communication if further information is needed.

- Enter your accounting period, incorporation date, and the start date of operations.

- Indicate the nature of the organization (e.g., charitable, educational) and answer the Yes/No questions regarding previous exemption applications and current federal tax exemption status.

- Provide detailed financial information and operations, including past and planned activities, income sources, and fundraising programs.

- Describe the governance structure by listing the names and titles of members of the board of directors, ensuring it consists of at least three individuals.

- Sign the form and include the title and date, affirming the accuracy of the information provided.

- Once all sections are complete, save your changes, and prepare to submit the form online or print it for mailing.

Start filling out the PR SC 2645 form online today to move forward with your tax exemption application.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Getting Permanent Residency (PR) in Puerto Rico involves following specific immigration procedures established by US law. This may include submitting an application, providing necessary documentation, and potentially securing sponsorship. Utilize services like US Legal Forms to help navigate the PR SC 2645 process efficiently and effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.