Get Dc D-40b 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DC D-40B online

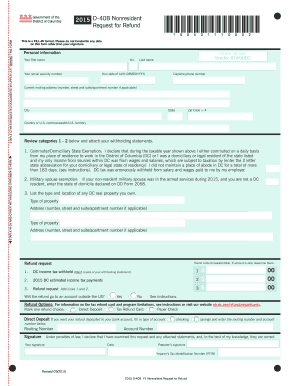

The DC D-40B form is designed for nonresidents of the District of Columbia claiming a refund for income tax withheld. This guide provides step-by-step instructions on how to complete the form accurately and efficiently online.

Follow the steps to fill out the DC D-40B online.

- Click the ‘Get Form’ button to access the DC D-40B form and open it in the online editor.

- Begin by entering your personal information in the designated fields. This includes your first name, middle initial, last name, social security number, date of birth, daytime phone number, current mailing address, city, state, zip code, and country or U.S. territory.

- Review the categories for exemptions to determine if you qualify. For commuters or domiciliary state exemption, indicate the state abbreviation and ensure your claim is supported by withholding statements.

- If applicable, provide details about your military spouse's residency status by entering the state of domicile during the tax year.

- List any DC real property you may own by providing the type of property and its location.

- Proceed to calculate your refund request. Add together the total DC income tax withheld and estimated tax payments. Round to the nearest dollar. If your refund amount is zero, leave the line blank.

- Choose your preferred refund option, selecting between direct deposit, tax refund card, or paper check. If you select direct deposit, fill in the type of account and enter the routing and account numbers.

- Sign and date the form, confirming that the information provided is accurate. If someone else prepared the form, they must also sign and provide their preparer's tax identification number.

- Once all sections are complete, review your entries for accuracy before saving your changes. You can then download, print, or share the completed form as needed.

Complete your DC D-40B refund request online today for a smooth and efficient filing process.

Get form

Related links form

To prepare an asset and liability statement, start by gathering documentation of all your financial resources and obligations. List each asset and its estimated value, followed by a clear outline of your liabilities. This statement is essential for accurately completing forms such as the DC D-40B.

Get This Form Now!

Fill DC D-40B

You need to file Form D-40B, Nonresident Request for Refund, to receive a refund of the taxes withheld. The D-40B form is a tax refund request for nonresidents of D.C. who have had taxes withheld during their time working in the district. Has anyone ever had this problem? This form is essential for nonresidents earning income in Washington, DC, ensuring they meet their local tax obligations. If the due date falls on a Saturday, Sunday, or legal holiday. Noting that the D40B form requires attachment of W2 form but not federal return, so income threshold issue may go unrecognized. Thanks. The D-40B form is an essential document for many people who have income related to the District of Columbia but do not consider it their state of residence. Forms are grouped into the following categories. Hugh Bowden of Ellsworth is a former Republican state representative and a lifelong journalist and political observer. Natural Gas Infrastructure: Even if half of the planned 110GW of gas plants get built, there aren't enough "gas highways" to feed them.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.