Loading

Get Or Or-cppr 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR OR-CPPR online

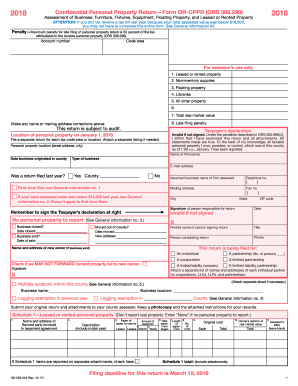

The Confidential Personal Property Return (OR OR-CPPR) is an essential form for individuals and businesses to report personal property for tax purposes. This guide provides clear and comprehensive instructions on how to complete the form online to ensure compliance and avoid penalties.

Follow the steps to effectively complete the OR OR-CPPR online.

- Click ‘Get Form’ button to obtain the OR OR-CPPR and open it in your editor.

- Begin by entering your account number and code area at the top of the form. Ensure that you make any necessary corrections to your name or mailing address.

- Proceed to fill out the sections pertaining to your business. Include the type of business, the date it originated in the county, and the mailing address. Make sure to indicate whether you filed a return last year.

- Complete the schedules applicable to your situation. Schedule 1 is for leased or rented personal property; Schedule 2 is for noninventory supplies; Schedule 3 is for floating property; Schedule 4 is for professional libraries; and Schedule 5 is for all other taxable personal property.

- Review all information entered for accuracy and completeness. Remember to sign the Taxpayer’s declaration. Confirm that you include all necessary attachments, especially if required by the schedules.

- Submit your completed return and any attachments to your county assessor. It's advisable to keep a photocopy of the return and instructions for your records.

Complete your OR OR-CPPR online today to ensure compliance and avoid penalties.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

An example of personal property includes office equipment like computers, furniture, and machinery used in a business setting. These items are distinct from real property, such as land or buildings. Properly classifying and reporting personal property is essential for meeting OR OR-CPPR requirements, and using tools like USLegalForms can simplify the process of declaration.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.