Loading

Get Or Or-ps 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR OR-PS online

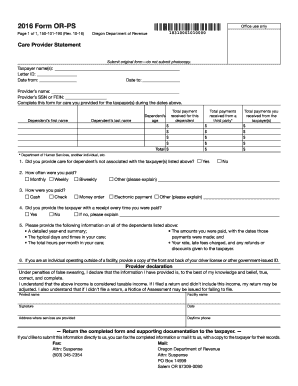

The Care Provider Statement (OR OR-PS) is an essential document for both providers and taxpayers to meet record-keeping requirements for credits related to child and dependent care. This guide will assist users in accurately completing the form online to ensure compliance with tax regulations.

Follow the steps to complete the Care Provider Statement online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the taxpayer name(s) at the top of the form. Ensure that you include both names if filing jointly.

- Locate the Letter ID provided in the correspondence from the Oregon Department of Revenue and enter it on the form. If you do not have a Letter ID, write your Social Security number in its place.

- Enter the start and end dates that correspond to the tax year during which care was provided, typically from January 1 to December 31.

- Provide the care provider's name and their Social Security Number (SSN) or Federal Employer Identification Number (FEIN).

- Detail the dependents' information, including their first and last names, ages, and the total payment received for each dependent.

- Outline total payments received from the taxpayer, ensuring the amounts correspond with the periods of care provided.

- Answer questions regarding the frequency of payments and payment methods. Please include any relevant details in the provided spaces.

- Affirm that receipts were provided for each payment; if not, give an explanation for this omission.

- Complete the provider declaration section, confirming the accuracy of the information provided by signing and dating the form.

- Return the completed form and any supporting documentation to the taxpayer or submit it directly to the Oregon Department of Revenue, ensuring the taxpayer receives a copy for their records.

Complete your Care Provider Statement online today to ensure compliance and streamline your tax filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, Oregon is currently accepting efile returns, making it easier for individuals to submit their taxes electronically. eFiling can accelerate the processing time for your return, allowing you to receive your refund sooner. To make this process even simpler, consider using US Legal’s eFiling solutions, which provide step-by-step assistance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.