Loading

Get Ks Request For Written Explanation Of Garnishee's Computation Of Earnings Withheld 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS Request for Written Explanation of Garnishee's Computation of Earnings Withheld online

This guide provides a clear and supportive approach to filling out the KS Request for Written Explanation of Garnishee's Computation of Earnings Withheld online. Whether you are familiar with legal procedures or new to the process, this comprehensive guide will assist you through each section of the form.

Follow the steps to complete the form accurately and efficiently.

- Click the ‘Get Form’ button to obtain the form and open it in the editor. Ensure that you have access to a reliable internet connection to facilitate this action.

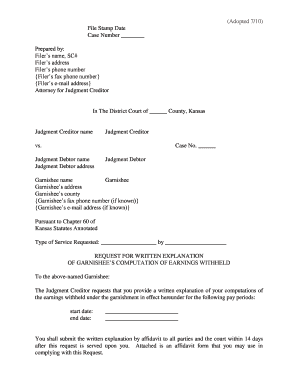

- Locate the file stamp date and case number sections at the top of the form. Fill in the appropriate dates and numbers related to your case.

- In the 'Prepared by' section, enter the name of the filer, the SC number, and the contact information including address and phone number.

- Next, specify details about the judgment creditor and the judgment debtor, such as their names and addresses.

- Complete the garnishee's information, including their name, address, and county. If available, provide their fax number and email address.

- In the section regarding the type of service requested, fill in the specific service type and the name of the person or entity performing the service.

- Indicate the start and end date for the pay periods for which you are requesting a written explanation of the earnings withheld. This is important for accurate computation.

- After completing all sections, review the information to ensure accuracy and consistency.

- Once reviewed, proceed to save changes to the document. You may then download, print, or share the completed form as needed.

Complete your forms online today to streamline your document management!

Related links form

Your paycheck will be garnished until the full amount of the debt is paid. That continues pay period after pay period until released by the creditor. This should occur when the entire debt, including interest, is paid.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.