Loading

Get Oh W-2report 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH W-2Report online

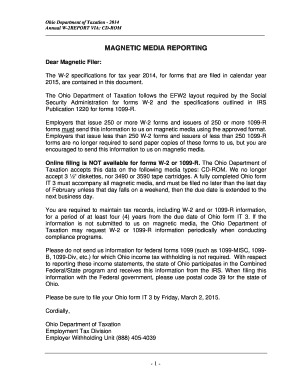

Filling out the OH W-2Report online can streamline the process of submitting wage and tax information to the Ohio Department of Taxation. This guide offers a clear and supportive approach to understanding and completing the W-2Report accurately.

Follow the steps to complete the OH W-2Report accurately.

- Press the ‘Get Form’ button to acquire the OH W-2Report form and open it for filling.

- Begin by entering the Submitter Record (Code RA). This is the first data record, and you will need to include your Employer Identification Number (EIN).

- Next, fill out the Employer Record (Code RE). This must be the second record and should contain details about your business, including the EIN and employer name.

- Complete the Employee Wage Records (Code RW). For each employee, include their Social Security Number, wages, and any applicable tax information.

- If necessary, fill in any Supplemental Records (Code RS) that pertain to specific state requirements or additional employee information.

- Calculate and enter the totals for each set of records in the Total Record (Code RT), ensuring accuracy in the wages and taxes reported.

- Close out your submission with the Final Record (Code RF), which must be the last record on the file, and ensure it reflects the total counts.

- After completing all records, save your progress. Make sure to review all entered data for accuracy before preparing to share the report.

- Finally, follow the submission guidelines to share the completed W-2Report and any accompanying documentation as required by the Ohio Department of Taxation.

Take the time to complete your OH W-2Report online accurately and in a timely manner.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To obtain an old W-2, first check with your former employer as they keep records for a certain period. If that's not possible, you can file a request with the IRS using Form 4506-T, allowing you to acquire a copy of your OH W-2Report. Remember, receiving older tax documents may take a bit longer, so it's best to act early to meet any upcoming deadlines.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.