Loading

Get Oh W-2report 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH W-2Report online

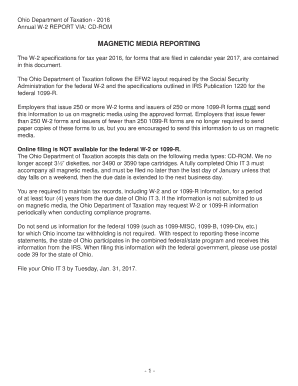

This guide provides a professional and thorough overview of the process for completing the OH W-2Report online. Following these steps will ensure that you accurately submit the required information.

Follow the steps to successfully complete your OH W-2Report.

- Click 'Get Form' button to obtain the form and open it in your preferred editing application.

- Review the submitter record requirements, ensuring that you gather the necessary information such as the Employer Identification Number (EIN) and contact details.

- Complete the employer record by entering the tax year, the EIN, and any associated establishment numbers if applicable.

- Input the employee wage records, ensuring each employee's information is accurately entered, including names and Social Security Numbers (SSNs).

- Fill out necessary fields regarding wages, tips, and any taxes withheld, ensuring that totals align correctly.

- Review all entries for accuracy, checking that all required information is included and that formatting requirements are met.

- Finalize your document by saving changes, then prepare to download or print the OH W-2Report for submission.

- Once completed, ensure your file is sent to the Ohio Department of Taxation either by mail or by following the submission guidelines provided.

Complete your OH W-2Report online today for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To get your W-2 information, start by contacting your employer or payroll department directly. They can provide you with copies or details of the OH W-2Report associated with your income. If you encounter any difficulties, US Legal Forms can assist you in navigating the process more efficiently. Remember to gather your personal identification when making inquiries to ensure a smoother experience.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.