Loading

Get Bir Form 1901 Editable 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bir Form 1901 Editable online

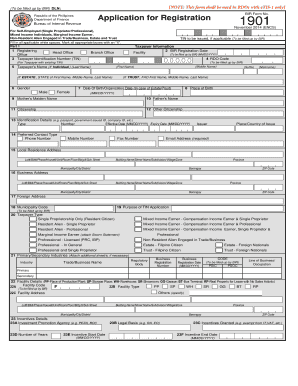

This guide provides comprehensive instructions on how to complete the Bir Form 1901 Editable online. The form is essential for individuals needing to register for a taxpayer identification number in the Philippines, accommodating various user situations including self-employed individuals and estates.

Follow the steps to fill out the Bir Form 1901 Editable online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Carefully review the pre-filled fields, if any, and fill in any applicable information. Ensure that all required sections are completed.

- Enter your Taxpayer Identification Number (TIN) in the designated field to ensure proper registration.

- Fill out your personal information including your full name, gender, date of birth, place of birth, and citizenship.

- Provide your identification details, including your identification type and number, as well as contact information such as email and phone numbers.

- Input your local residence address and, if applicable, your business address. Make sure to include all fields required to avoid delays in processing.

- Indicate the purpose of your TIN application by selecting the appropriate options from the dropdown menu.

- In the taxpayer type section, select the category that best describes your situation—such as single proprietorship or professional.

- Once all sections are complete, review all the filled information for accuracy and completeness.

- Save your changes, then download, print, or share the completed form as necessary.

Complete your application efficiently by accessing the Bir Form 1901 Editable online today.

Yes, you can download BIR forms from various online resources, including the official BIR website. These forms are often available in different formats, requiring a compatible program to open. One option is to use the Bir Form 1901 Editable, which provides a user-friendly way to fulfill your tax obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.