Loading

Get Uk Hmrc P85 2000

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC P85 online

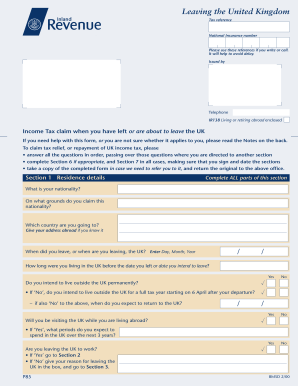

The UK HMRC P85 form is essential for individuals who are leaving the United Kingdom and wish to claim tax relief or repayment. Completing this form accurately can ensure that you avoid any unnecessary delays in your tax-related matters.

Follow the steps to successfully complete the P85 form.

- Press the 'Get Form' button to retrieve the P85 form and open it in your preferred editor.

- Begin by entering your personal details. Fill out your tax reference and National Insurance number. These identifiers help the HMRC process your application without delay.

- Complete Section 1 regarding your residence details. Answer all questions thoroughly, including your nationality, your intended destination country, and your departure date from the UK.

- In Section 2, provide your employment details if you are leaving the UK to work. Include your job type, employer’s name and address, and confirm if you will work full-time or have a separate contract.

- In Section 3, answer questions related to your accommodation in the UK while abroad. Specify the type of accommodation and any outstanding mortgages or loans on that property.

- Continue to Section 4 to report any rental income or earnings from properties in the UK. Indicate whether income will be received directly or through an agent.

- In Section 5, provide information about any additional income sources after leaving the UK, including life insurance policies or personal pensions.

- Complete Section 6 to claim any tax repayments. Indicate your repayment address and, if applicable, provide details for a nominee who can receive payment on your behalf.

- Finally, fill out Section 7 with your declaration, confirming that all information provided is accurate. Sign and date this section.

- Once the form is complete, save your changes, and you can choose to print, download, or share the form as needed.

Complete the UK HMRC P85 form online to ensure a smooth process for your tax claims.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

After leaving the UK, you can claim your tax back by completing the P85 form and submitting it to HMRC. This form is essential in ensuring that your tax affairs are correctly handled and that any eligible refunds are processed. Keep all relevant documentation handy to support your claim.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.