Get Planmember Services Program Ira Distribution Form 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PlanMember Services Program IRA Distribution Form online

Filling out the PlanMember Services Program IRA Distribution Form online can streamline your retirement account distribution process. This guide provides clear, step-by-step instructions to assist you in completing each section of the form accurately and efficiently.

Follow the steps to complete the form smoothly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

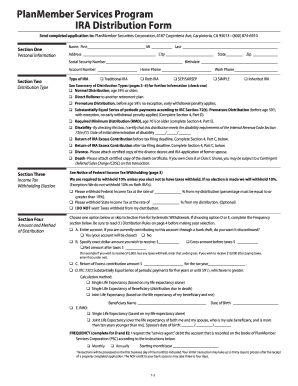

- Section One requires your personal information. Fill in your first name, middle initial, and last name, along with your address, city, state, zip code, Social Security number, birthdate, account number, and contact numbers. Ensure all information is accurate.

- In Section Two, choose the type of IRA you have by checking the appropriate box (Traditional IRA, Roth IRA, SEP/SARSEP, SIMPLE, or Inherited IRA). Then select the type of distribution you are requesting. Make sure to understand your choices by reviewing the provided summary of distribution types if needed.

- Section Three involves the income tax withholding election. You may select a percentage for federal income tax withholding or choose not to have taxes withheld by checking the designated box. Remember that certain rules apply to Roth IRAs.

- For Section Four, determine the amount and method of your distribution. Choose one option, such as taking the entire account, specifying an exact amount, or opting for systematic withdrawals, and complete any necessary details based on your choice.

- In Section Five, if you are opting for systematic withdrawals, select the fixed amount you wish to withdraw, the frequency of the withdrawals, and any other relevant strategies outlined in the section.

- In Section Six, indicate who the recipient of the distribution will be. Choose whether it is for the participant, an alternate payee, or another custodian, and provide required identification.

- Section Seven outlines payment instructions. Specify where the check should be sent or if the funds should be direct deposited, including any necessary banking information.

- In Section Eight, indicate how you would like your fund distribution handled. You can choose between pro-rata or from specific funds listed. Make your selections clear.

- Section Nine requires a Medallion Signature Guarantee if applicable. Follow the instructions regarding signature guarantees to ensure your application is valid.

- Review all entries for accuracy and completeness, then save changes, download, print, or share the completed form as required.

Complete your PlanMember Services Program IRA Distribution Form online today to manage your retirement assets effectively.

For reporting IRA distributions, you typically need Form 1099-R. This form is issued by your financial institution to report distributions you have taken. However, if you had non-deductible contributions to your IRA, you may also need Form 8606. To clarify your specific situation and make the process easier, consult the PlanMember Services Program IRA Distribution Form.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.