Loading

Get Kansas K 4 Rev 1013 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Kansas K 4 Rev 1013 Form online

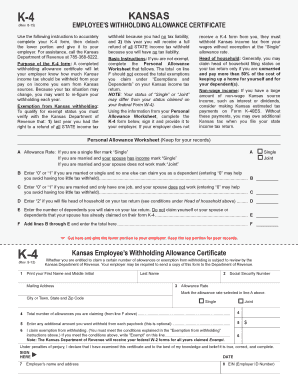

Filling out the Kansas K 4 Rev 1013 Form online can simplify your tax processes. This guide will provide you with clear instructions on each section to ensure you complete the form accurately and efficiently.

Follow the steps to fill out the Kansas K 4 Rev 1013 Form online.

- Click ‘Get Form’ button to access the Kansas K 4 Rev 1013 Form and open it in the editor.

- Begin by entering your personal information in the designated fields. This typically includes your name, address, and Social Security number. Make sure to double-check the accuracy of the information you provide.

- Next, indicate your filing status by selecting the appropriate option. Options may include single, married filing jointly, married filing separately, or head of household. Choose the option that best describes your situation.

- In the following section, provide information about your dependents, if applicable. Include their names, relationship to you, and Social Security numbers. Ensure that all dependents are listed correctly, as this can affect your tax calculations.

- Complete the section related to your income. This may involve reporting various sources of income, such as wages, salaries, and interest earned. Accurately list each source to reflect your total income.

- Review any applicable tax credits or deductions that you may qualify for. This section will often allow you to reduce your taxable income, so make sure to include any eligible deductions.

- Finally, review the entire form for accuracy and completeness. Once you are satisfied with the information provided, proceed to save your changes. Options may include downloading the form, printing it for your records, or sharing it as needed.

Get started on completing your documents online today!

To email the Kansas Department of Revenue, you need to visit their official website for the appropriate contact email. This information is essential for inquiries regarding tax forms, including the Kansas K Form. Having an accurate email address will facilitate communication and help resolve your concerns efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.