Get 7! 1de4p Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 7! 1de4p Form online

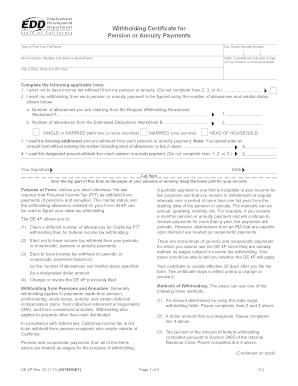

Filling out the 7! 1de4p Form online can seem daunting, but with clear instructions, you can complete it efficiently. This guide will walk you through the necessary steps to accurately fill out the form, ensuring that your pension or annuity tax withholding is set up correctly.

Follow the steps to fill out the 7! 1de4p Form online successfully.

- Press the ‘Get Form’ button to obtain the form and open it in the editing interface.

- Type or print your full name in the designated field.

- Enter your Social Security number accurately.

- Fill in your home address, including the number and street or rural route.

- Provide your claim or identification number, if applicable, from your pension or annuity contract.

- Complete the city or town, state, and ZIP code fields.

- In section one, select the option to elect not to have income tax withheld from your pension or annuity, if that applies to you.

- In section two, indicate the number of allowances you are claiming and your marital status, selecting from the available options.

- If you wish to have an additional amount withheld, indicate that amount in section three, ensuring you enter the number of allowances on line two.

- In section four, specify any designated amount you would like withheld from your payments, if applicable.

- Sign and date the form at the designated areas to confirm accuracy.

- After filling out the form, you can save your changes, download, print, or share the completed document as needed.

Take control of your tax withholding by completing the 7! 1de4p Form online today!

Filing Form W-7 online is not currently possible; however, you can complete the form electronically and then print it for submission by mail. It is important to ensure that you include all necessary documentation when you send your W-7. This form is essential for obtaining an Individual Taxpayer Identification Number, so accuracy matters greatly. Utilize uslegalforms to access helpful resources that guide you through the completion of the W-7 form effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.