Get D 4 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the D 4 Form online

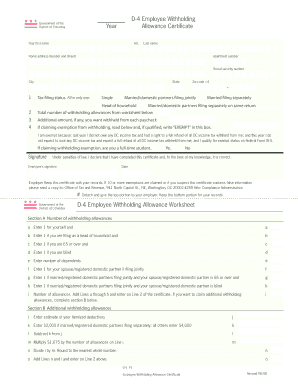

Filling out the D 4 Form online is an important step for new employees in the District of Columbia who need to have their taxes withheld appropriately. This guide provides clear and comprehensive instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the D 4 Form online.

- Click ‘Get Form’ button to obtain the D 4 Form and open it in your preferred online editor.

- Begin by entering your first name, middle initial, and last name in the appropriate fields. Then, provide your home address, including the apartment number, city, state, and zip code plus four digits.

- Input your social security number in the designated field, which is essential for identification purposes.

- Select your tax filing status by checking the appropriate box. You may choose from Single, Married/domestic partners filing jointly, Head of household, or Married filing separately.

- Fill in the total number of withholding allowances from the worksheet provided. Use the worksheet to accurately calculate your allowances based on your personal situation.

- If you wish to have an additional amount withheld from your paycheck, enter that dollar amount in the space provided.

- If you are eligible and wish to claim exemption from withholding, read the qualifications carefully and write 'EXEMPT' in the specified box.

- Indicate if you are a full-time student, by checking 'Yes' or 'No' if you are claiming an exemption.

- Sign and date the form to certify that the information is correct to the best of your knowledge.

- Save your changes, then download or print the completed form. Remember to detach the top portion to submit to your employer and keep the bottom portion for your records.

Start completing your D 4 Form online today to ensure your tax withholding is accurate.

Under recent IRS guidelines, you can no longer simply claim 1 on the D 4 Form without understanding the related tax implications. The IRS encourages taxpayers to consider their entire financial picture, leading many to consider their withholding strategy carefully. It's crucial to adjust your claims based on individual situations to avoid surprises during tax season. Utilize resources from USLegalForms for the latest information and customized advice on your W4 claims.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.