Loading

Get Nj Aa202 2005-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ AA202 online

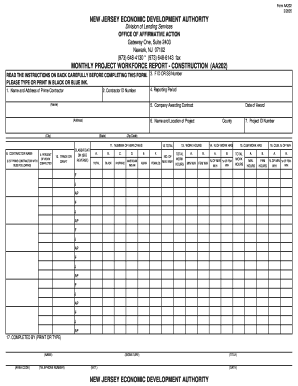

The NJ AA202 form is a vital document used for reporting workforce information related to construction projects in New Jersey. This guide provides clear and supportive instructions to ensure users can effectively complete the form online, even with little legal experience.

Follow the steps to successfully complete the NJ AA202 online.

- Click ‘Get Form’ button to access the NJ AA202 document and open it in your preferred editor.

- Fill in the name and address of the prime contractor in the designated fields. Ensure accuracy for effective communication.

- Enter the contractor ID number assigned by the Office of Affirmative Action, ensuring that it matches the official records.

- Input the Federal Identification Number or Social Security Number as required. This should be the number assigned to the contractor or, if not applicable, to an owner or partner.

- Indicate the reporting period by filling in the beginning and ending dates of the month for the report submission.

- Provide the complete name of the public agency awarding the contract, alongside the date when the contract was awarded.

- Enter the name and location of the project, including the county in which it is situated.

- Fill in the project ID number assigned by the NJ Economic Development Authority.

- List the company names of all contractors involved, starting with the prime contractor followed by any subcontractors.

- Detail the total percentage of work completed by each contractor or subcontractor.

- Identify the trades or crafts relevant to each contractor or subcontractor listed.

- Provide the total number of employees for each contractor, detailing classifications and inclusion of minority groups.

- Enter the total work hours for employees, specifying hours for minority and female workers.

- Calculate and enter the percentage of work hours attributed to minorities and females.

- Complete details of cumulative work hours for each craft and classification, ensuring to account for minority and female contributions.

- Lastly, fill in the name, signature, title, telephone number, and date of the official submitting this report.

- Once all fields are completed, save your changes, and you may choose to download, print, or share the form as necessary.

Complete your NJ AA202 form online today to ensure compliance and accurate reporting.

Yes, if you earn income in New Jersey as a nonresident, you must file a tax return. Filing helps you meet your tax obligations and avoid potential fines. You can also engage platforms like US Legal Forms for guidance on completing your NJ nonresident tax return efficiently. Staying informed and compliant is the best approach.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.