Loading

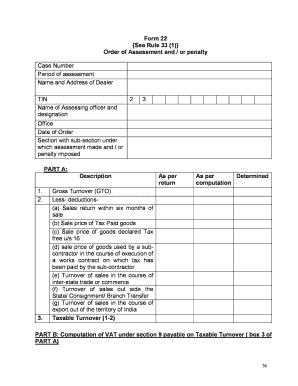

Get Form 22 See Rule 33 (1) Order Of Assessment And / Or Penalty ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 22 See Rule 33 (1) Order of Assessment and / or Penalty online

Filling out the Form 22, which pertains to the Order of Assessment and/or Penalty, is a crucial step in the assessment process. This guide will walk you through the necessary steps to complete this form online efficiently and accurately.

Follow the steps to successfully complete your Form 22 online.

- Click the ‘Get Form’ button to access the Form 22 and open it for editing.

- Enter the case number in the designated field. This number is essential for identifying your assessment.

- Provide the period of assessment, indicating the relevant timeframe for the assessment process.

- Fill in the name and address of the dealer. This information is necessary for the accurate processing of the form.

- Input the Tax Identification Number (TIN) in the specified field to facilitate tax identification.

- List the name and designation of the assessing officer responsible for your case.

- Record the date of the order in the corresponding section to maintain an accurate timeline.

- Specify the section, including any sub-sections, under which the assessment is made or the penalty is imposed.

- In PART A, detail the gross turnover and deductions according to your records. Make sure to include all relevant sales returns and exemptions.

- Move to PART B to compute the VAT payable based on the taxable turnover indicated in PART A. Accurately apply the applicable VAT rates.

- Continue to PART C to assess the purchase tax under section 10 by detailing the purchases liable for tax.

- In PART D, include any reversals of input tax rebate as outlined in section 14, ensuring to follow the provided computation accurately.

- PART E requires you to indicate the input tax rebate on goods other than plant and machinery. Fill this in carefully.

- Complete PART F by detailing the input tax rebate specifically for plant, machinery, and related equipment.

- Assess any interest for late payment in PART G, detailing the interest admitted by the dealer and the levied interest.

- Detail any penalties imposed in PART H and provide the relevant section number.

- Finally, in PART I, summarize the total payable or refundable amounts and ensure you complete the payment details section accurately.

- Once all sections are completed, you can save changes, download, print, or share the form for future reference.

Complete your Form 22 online today to ensure a smooth assessment process.

Calculating your underpayment penalty involves determining the amount of tax you underpaid throughout the year. You can use IRS Form 2210 for these calculations, which identifies shortfalls in your estimated tax payments. This connects to the guidelines of Form 22 See Rule 33 (1) Order Of Assessment And / Or Penalty. For a clearer understanding, UsLegalForms can provide valuable resources that explain the entire process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.