Loading

Get Form1040department

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form1040department online

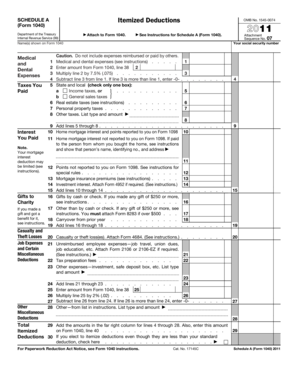

Filling out the Form1040department online can be a straightforward process with the right guidance. This guide will walk you through each section of the form, ensuring that you accurately complete it to fulfill your tax obligations.

Follow the steps to fill out the form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your social security number in the designated field. This is crucial for the identification of your tax record.

- In the section for medical and dental expenses, enter the total amount from Form 1040, line 38. Be mindful to include only eligible unreimbursed expenses.

- Multiply the amount from step 3 by 7.5% (0.075) to calculate the threshold for deductible expenses.

- Subtract the result from step 4 from the amount entered in step 3. If the result is less than or equal to zero, enter ‘-0-’ in the space provided.

- Select the type of state and local taxes paid by checking either the ‘Income taxes’ or ‘General sales taxes’ box.

- Enter real estate taxes paid in the next field, followed by any personal property taxes.

- If applicable, detail any other taxes in the space provided, listing the type and amount.

- Total the amounts from the previous lines to complete the taxes section.

- Report any home mortgage interest either reported on Form 1098 or not reported but paid to the seller.

- Include points not reported on Form 1098 and any mortgage insurance premiums paid.

- Summarize the total deductions from all applicable sections of the form.

- If you made gifts to charity, report them appropriately, ensuring you follow the instructions for gifts exceeding $250.

- Report any casualty or theft losses by detailing them and attaching Form 4684 if necessary.

- Record any unreimbursed job expenses, tax preparation fees, and any other miscellaneous deductions.

- Add all total amounts and ensure you enter the final total on Form 1040, line 40.

- Finally, check the box if you elect to itemize your deductions, even if lower than the standard deduction.

- Review all entries for accuracy before saving changes. You can also download, print, or share the form as needed.

Complete your Form1040department online to ensure accuracy and compliance.

You can pick up 1040 forms at various locations, including local IRS offices and certain public libraries. Additionally, the Form1040department provides options for accessing these forms readily. Call ahead to ensure the location has the forms you need available.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.