Loading

Get New Trust Reporting Requirements For T3 Returns Filed For Tax ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the New Trust Reporting Requirements For T3 Returns Filed For Tax online

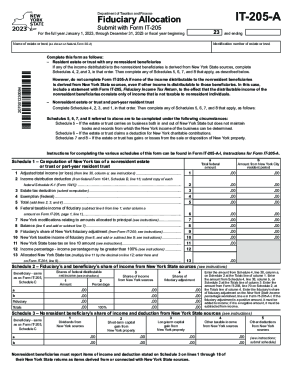

This guide provides clear instructions on completing the New Trust Reporting Requirements for T3 returns filed for tax purposes online. By following the steps outlined below, users can efficiently fill out and submit the necessary documentation.

Follow the steps to accurately complete the form.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering the name of the estate or trust as it appears on federal Form SS-4, along with the identification number of the estate or trust.

- Complete the section pertaining to the type of estate or trust. If it is a resident estate or trust with nonresident beneficiaries, make sure to complete Schedules 4, 2, and 3 in that order.

- For nonresident estate or trust and part-year resident, fill out Schedules 4, 2, 3, and 1 sequentially. Ensure that you follow the instructions for each schedule carefully.

- If required by the nature of the estate or trust, continue to complete Schedules 5, 6, 7, and 8 based on the specific circumstances as detailed in the instructions.

- Throughout the process, refer to Form IT-205-A-I, which contains further instructions for completing each relevant section.

- Once all sections and schedules are completed, review the information for accuracy.

- Finally, save the changes made to the form, download it for your records, and print or share as necessary.

Take the next step and complete your trust reporting requirements online.

The income shown on the T3 slip could be in the form of interest, dividends, and capital gains, and is taxable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.