Loading

Get Realty Transfer Tax Statement Of Value (rev-183). Forms &amp

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Realty Transfer Tax Statement of Value (REV-183) online

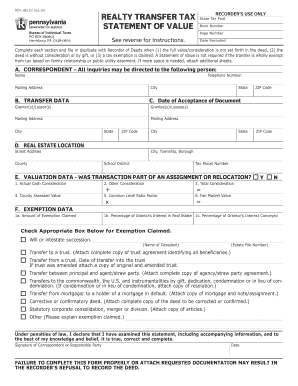

The Realty Transfer Tax Statement of Value (REV-183) is essential for documenting property transfers and ensuring compliance with tax regulations. This guide provides clear, step-by-step instructions for efficiently completing this form, whether you are an experienced user or new to the process.

Follow the steps to accurately complete your Realty Transfer Tax Statement of Value.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Section A, enter the name, address, and telephone number of the person completing the form. Ensure all details are accurate to facilitate any inquiries.

- In Section B, provide the full names and addresses of all grantors/lessors and grantees/lessees. Use additional sheets if space is insufficient.

- In Section C, note the date the document was delivered to and accepted by the grantee/lessee. This is crucial for record-keeping.

- For Section D, completely identify the real estate being transferred, including the street address, city, county, and tax parcel number if applicable.

- In Section E, indicate if the transaction involves multiple transactions and provide the required financial data, including actual cash consideration and total consideration.

- Complete Section F only if claiming an exemption. Fill out the requested information and check the appropriate exemption box as necessary.

- After thoroughly reviewing the information provided, ensure the form is signed by a responsible person connected with the transaction.

- Finally, save changes to the form, download it for your records, print a copy if needed, or share it as required with relevant parties.

Complete your Realty Transfer Tax Statement of Value online to ensure a smooth and compliant property transfer.

Related links form

There is a Transfer Tax of 2% (1% to the state and 1% to the municipality and school district) for all property sales in Pennsylvania on the value of the property or interest being conveyed. This value is not necessarily the sales price. The 2% Transfer Tax is paid at the time of recording.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.