Loading

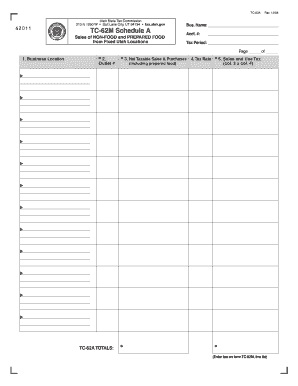

Get Ut Tc-62m Schedule A 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT TC-62M Schedule A online

This guide provides a comprehensive overview of the UT TC-62M Schedule A, designed to assist you in accurately completing the form online. Whether you are familiar with tax forms or new to the process, this step-by-step approach will help you navigate through each component with ease.

Follow the steps to fill out the UT TC-62M Schedule A effectively.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

- In the first section labeled 'Business Location,' enter your business name, account number, and the applicable tax period. Ensure all information is accurate to avoid issues with your submission.

- Next, locate the section labeled 'Outlet #.' Enter the relevant outlet number associated with your business. This will help the tax commission identify the correct location for your sales records.

- Proceed to 'Net Taxable Sales & Purchases' to report your total non-food and prepared food sales made from fixed locations in Utah. This information is crucial for accurate tax calculations.

- In the 'Tax Rate' section, enter the appropriate sales tax rate. Verify this rate based on the latest guidelines provided by the Utah State Tax Commission to ensure compliance.

- Calculate the 'Sales and Use Tax' by multiplying the net taxable sales (from step 4) by the tax rate (from step 5). Enter the result in the designated field.

- Finally, add the total sales and use tax amount calculated in step 6 to the TC-62A totals field on form TC-62M, specifically line 8a. Review all entries for accuracy.

- Once you have filled out the form, you can save your changes, download a copy, print it, or share the form as needed. Don't forget to use the 'Clear form' button to protect your privacy after submitting.

Complete your UT TC-62M Schedule A online for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Common Exemptions from Utah Sales and Use Tax: Medical Devices, Equipment, and Supplies. Durable Medical Equipment includes equipment for home use, including repair and replacement parts. Mobility-Enhancing Equipment includes equipment sold under a doctor's written prescription, including repair and replacement parts.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.