Get Pr Sc 2645 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR SC 2645 online

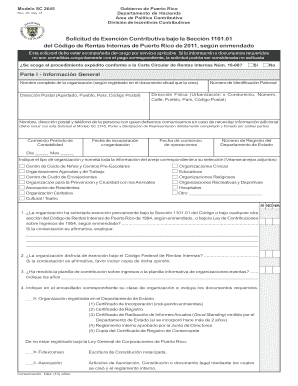

The PR SC 2645 form is an important document for organizations seeking tax exemption under Puerto Rico's Internal Revenue Code. This guide provides comprehensive, step-by-step instructions on completing the form online, ensuring that even users with little legal experience can navigate the process effectively.

Follow the steps to complete the PR SC 2645 form online.

- Press the ‘Get Form’ button to access the form and open it in the online editor.

- Begin by filling out the Général Information section. Provide the full name of your organization as per the official document, postal address, employer identification number (Número de Identificación Patronal), and physical address. Include contact information for an individual who can provide further details if needed.

- Indicate the start date of your accounting period, incorporation date, operational start date, and state registration number as required.

- Select the type of organization from the provided list and submit the necessary attachments for your selection. Each type has specific requirements involving additional documentation.

- Answer the questions regarding previous exemption applications or federal tax exemptions, and provide additional explanations where necessary. Be sure to attach supporting documents for these responses.

- Complete Part II, detailing the organization’s activities and operations. This includes providing comprehensive descriptions of past and future activities, sources of income, and fundraising programs.

- Follow the queries in this section carefully, answering each question with the required details. Be sure to include attachments whenever referenced.

- After completing all sections, review the entered information for accuracy and completeness before final submission.

- Upon verification, save your changes. Download or print the completed form and all relevant documents before submission.

- Submit the form and the applicable service fee via the designated methods, ensuring all documents are attached as specified.

Start filling out your PR SC 2645 form online today for swift processing of your tax exemption request.

Related links form

To calculate rental income from Form 8825, start by totaling all rental income received during the tax year. Subtract any eligible expenses claimed on the form, in accordance with PR SC 2645 guidelines, to determine your net rental income. Platforms like UsLegalForms can provide calculators and tools that ensure you accurately assess your rental income, aiding in better tax filing.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.