Loading

Get Ms Dor Form 80-110 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MS DoR Form 80-110 online

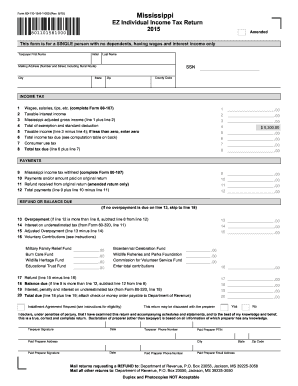

Filling out the MS DoR Form 80-110 online is a straightforward process designed for individuals with wages and interest income. This guide provides detailed instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the form seamlessly.

- Press the ‘Get Form’ button to access the form and open it in the editing interface.

- Enter your first name, middle initial, and last name in the appropriate fields.

- Provide your mailing address, including the street number and name, city, state, county code, and zip code.

- Input your social security number (SSN) in the designated field.

- For income details, report your wages, salaries, tips, etc., in line 1 and enter your taxable interest income in line 2.

- Calculate your Mississippi adjusted gross income by adding line 1 and line 2, and enter the total on line 3.

- From line 3, subtract $8,300 for the standard deduction to find your taxable income, ensuring that if the result is less than zero, you enter zero on line 5.

- Determine your total income tax due using the computation table provided, and enter this figure on line 6.

- Report any consumer use tax owed in line 7 if applicable.

- Add lines 6 and 7 to get your total tax due and enter this amount on line 8.

- Complete the payments section by entering any Mississippi income tax withheld in line 9 and other relevant payment details in lines 10 and 11.

- Calculate total payments in line 12 by adding lines 9 and 10 and subtracting line 11.

- If you have an overpayment (line 12 exceeds line 8), calculate the amount on line 13; otherwise, proceed to line 18.

- Fill out lines for interest on underestimated tax and adjusted overpayment as required.

- If applicable, specify the voluntary contributions you wish to make on line 16.

- Finalize by determining your refund or balance due, indicating any necessary payment details as outlined.

- Review all entries for accuracy, and use the options to save changes, download, print, or share the form as needed.

Complete and submit your MS DoR Form 80-110 online today to ensure timely processing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The Internal Revenue Service (IRS) administers and enforces U.S. federal tax laws.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.