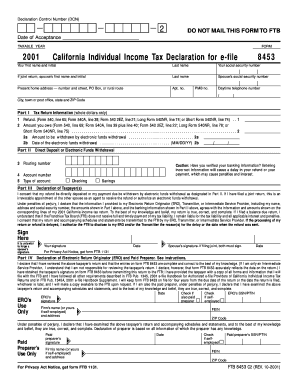

Get Declaration Control Number (dcn) 2 Do Not Mail This Form To Ftb Date Of Acceptance Taxable Year

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Declaration Control Number (DCN) 2 DO NOT MAIL THIS FORM TO FTB Date Of Acceptance TAXABLE YEAR online

Filling out the Declaration Control Number (DCN) form is a critical step in submitting your California individual income tax electronically. This guide provides clear instructions on how to accurately complete the form, ensuring your return is processed smoothly and efficiently.

Follow the steps to complete your DCN form online.

- Click the ‘Get Form’ button to obtain the Declaration Control Number form and open it in your preferred editing tool.

- Enter the date of acceptance in the specified field. Ensure that it reflects the date when your tax return was accepted by the Franchise Tax Board (FTB).

- Indicate the taxable year for which you are filing the return. This should correspond to the year relevant to your income taxes.

- Fill in your first name and initial, followed by your last name in the provided fields.

- Input your Social Security number accurately to confirm your identity during processing.

- If filing jointly, provide your spouse’s first name and initial, last name, and Social Security number in the respective fields.

- Complete your present home address including the number and street, apartment number (if applicable), and the city, state, and ZIP code.

- Enter your daytime telephone number to allow for any necessary communication regarding your return.

- In Part I, report the refund amount or any balance owed as per the instructions for the corresponding tax forms you are completing.

- Complete Part II with your bank's routing number, account number, and specify if it is a checking or savings account for direct deposit or electronic funds withdrawal.

- In the Declaration of Taxpayer(s) section, provide your signature and date. If filing jointly, the spouse must also sign and date.

- If applicable, EROs and preparers must also fill out and sign Part IV, ensuring all necessary information is complete.

- Review all entries for accuracy. Once confirmed, you can choose to save changes, download, print, or share the completed form as needed.

Complete your Declaration Control Number form online today for a smooth e-filing experience.

To authorize a specific individual to access confidential information and represent a taxpayer before the Franchise Tax Board, you need to complete the IRS Form 2848, Power of Attorney and Declaration of Representative. This form grants designated individuals the legal power to act on your behalf, facilitating smoother dealings with the FTB. When filled out correctly, it streamlines communication surrounding your Declaration Control Number (DCN) 2 DO NOT MAIL THIS FORM TO FTB Date Of Acceptance TAXABLE YEAR.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.