Loading

Get Mi Form 382 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI Form 382 online

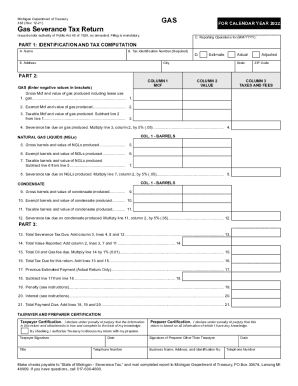

Filling out the MI Form 382, Gas Severance Tax Return, can be a straightforward process with the right guidance. This guide provides detailed, step-by-step instructions to ensure users accurately complete the form online.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to access the form and open it in the editor.

- In Part 1, fill in your identification information. Enter your legal name in Box A, your Tax Identification Number in Box B, and the address details in Box E. Specify the reporting period by filling in Box C with the required MM/YYYY format. Select the type of return in Box D by checking only one option: Estimated, Actual, or Adjusted.

- In Part 2, report the gas volumes in Mcf’s. Begin with Line 1 by entering the total Mcf’s of gas produced in Column 1 and its value in Column 2. Continue to Line 2, where you will report exempt volumes and values. Use Line 3 to calculate taxable amounts by subtracting Line 2 from Line 1.

- Multiply the taxable gas value from Line 3, Column 2 by 5% (.05) to determine the severance tax due for gas, which is reported on Line 4, Column 3.

- For Natural Gas Liquids (NGLs) and condensate, report the data in barrels across designated lines from 5 to 12, following similar steps as with gas. This includes reporting gross, exempt, and taxable amounts.

- In Part 3, add the total severance tax due from lines 4, 8, and 12, and report this on Line 13. Calculate the total value reported for the taxable amounts in Line 14, and compute the oil and gas fee due on Line 15. Finally, combine these amounts to arrive at the total tax due for the return in Line 16.

- Provide any previous estimated payment in Line 17 if applicable. Subtract this amount from the total tax due reported in Line 16, and complete Line 21 to determine the final payment due by adding any applicable penalties and interest.

- Ensure the form is signed by an authorized individual and submit the completed form and any payment to the Michigan Department of Treasury following the guidelines provided.

- Save changes made to the form, and you may choose to download, print, or share the document as needed.

Get started on completing your MI Form 382 online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Need Products to Complete Your 2023 Tax Return? You can place your order here for tax forms, instructions and publications. We will process your order and ship it by U.S. mail when the products become available.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.