Loading

Get Dtf 719 Mn Form Online

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dtf 719 Mn Form Online online

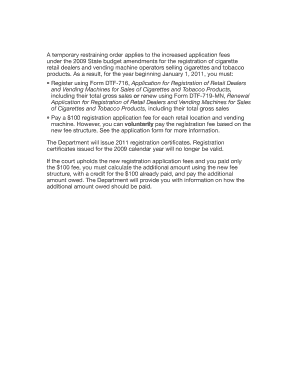

Filling out the Dtf 719 Mn Form Online is essential for businesses seeking to renew their registration as retail dealers or vending machine operators for the sale of cigarettes and tobacco products. This guide provides you with a clear, step-by-step approach to ensure that you complete the form accurately and efficiently.

Follow the steps to fill out the Dtf 719 Mn Form Online successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your legal business name and the date on which you are completing the form. Ensure that you type or print clearly.

- Provide your Doing Business As (DBA) or trade name if different from your legal name, and include your sales tax vendor identification number.

- Fill in your mailing address, including the city, state, and ZIP code, making sure to provide a contact name if applicable.

- Indicate your business telephone number in the designated field.

- Mark an X in the appropriate box to indicate if you are a new applicant or renewing your registration for additional locations or vending machines.

- Select how you are selling the cigarettes or tobacco products by marking the relevant boxes for retail locations and/or vending machines.

- Fill in the date you began or will begin business, as well as the date you began or will begin selling cigarettes or tobacco products.

- Mark an X to identify your type of organization, selecting from options such as individual, corporation, government entity, exempt organization, trust, partnership, or other.

- For Part A, list the business names and addresses for each location and indicate the gross sales for the previous year by marking the corresponding X in the appropriate column.

- For Part B, similarly enter the business name and address for each vending machine while marking the applicable gross sales.

- Calculate the total amount due based on the fee scale and your reported sales. Ensure the correct amounts are entered in the designated areas.

- Print your form after reviewing all entries for accuracy, and affix your signature along with the date.

- Finally, attach your payment by check or money order as specified and mail your completed application to the provided address.

Complete your Dtf 719 Mn Form Online today and ensure your business remains compliant with state regulations.

Related links form

All states and the District of Columbia tax cigarettes, but rates vary significantly. Missouri imposes the lowest state cigarette tax rate at just $0.17 per pack, followed by Georgia ($0.37), North Dakota ($0.44), and North Carolina ($0.45).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.