Loading

Get Fixed-sum Loan Agreement Regulated By The Consumer Credit Act 1974

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fixed-Sum Loan Agreement regulated by the Consumer Credit Act 1974 online

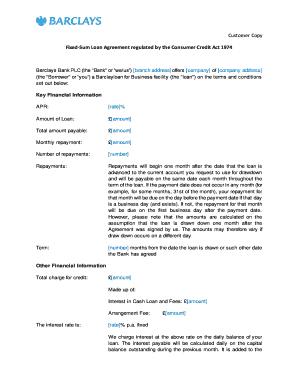

Filling out the Fixed-Sum Loan Agreement regulated by the Consumer Credit Act 1974 online can be a straightforward process if you follow the right steps. This guide will walk you through each section of the form, ensuring you provide all necessary information correctly.

Follow the steps to complete your loan agreement accurately.

- Click the ‘Get Form’ button to access the Fixed-Sum Loan Agreement. This will open the form in your preferred online editor.

- Begin by entering your personal details as the Borrower. Include your full name, address, and contact information accurately in the designated fields.

- Next, fill in the loan details section. Specify the amount of the loan you are requesting, using the format provided. Ensure that the APR and total amount payable are clearly stated.

- Indicate the monthly repayment amount and confirm the number of repayments. This information can often be calculated based on the loan amount and terms.

- Review the repayment schedule carefully. Make sure you understand the timing of your repayments and adjust any settings as necessary.

- Fill out the section regarding fees and charges. Ensure that you include any interest rates, arrangement fees, and other costs associated with the loan.

- Provide the business lending declaration by affirming that you are entering into the agreement for business purposes. This helps affirm compliance with regulations.

- Read through the agreement terms and conditions thoroughly. Acknowledge that you understand these conditions by signing where indicated.

- After completing all sections accurately, save your changes to the document. You can then choose to download, print, or share the completed form as needed.

Start filling out your Fixed-Sum Loan Agreement online today to take the next step in securing your business financing.

Debts which are covered by the Consumer Credit Act are often called regulated debts. This applies to most of the common household borrowing. In most cases, the following debt types will be regulated by the Consumer Credit Act: Credit cards.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.