Loading

Get Id Dgt 2 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ID DGT 2 online

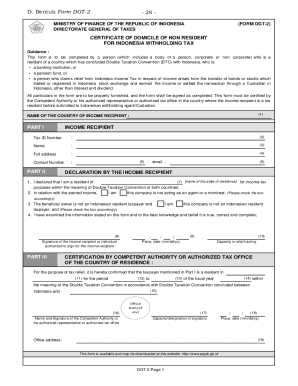

The ID DGT 2 form is essential for non-residents seeking relief from Indonesian withholding tax under the Double Taxation Convention. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the ID DGT 2 form online.

- Press the ‘Get Form’ button to access the ID DGT 2 form and open it in your preferred editor.

- In Part I, provide the name of the country of the income recipient, and fill in the Tax ID Number, full name, full address, and contact number.

- Complete the email address field to facilitate further communication and verification.

- In the Declaration by the Income Recipient section, confirm your residency status by typing the state of residence and checking the appropriate boxes regarding agency and taxpayer status.

- Ensure you sign the form in the designated area, and provide the date and place of signing along with your capacity in which you are acting.

- Move to the Certification section to be completed by the Competent Authority or tax office from your country, ensuring they confirm your residency for tax relief.

- In Part IV, list the types of income earned from Indonesia for which you are claiming relief, specifying the amounts and relevant percentages where applicable.

- Sign and date the form again in the Income Earned section, indicating your capacity.

- Review all filled-out information for accuracy before finalizing your document.

- Finally, save your changes, and choose to download, print, or share the completed form as necessary.

Complete your ID DGT 2 form online today for efficient tax relief processing.

Page 1. MINISTRY OF FINANCE OF THE REPUBLIC OF INDONESIA. (FORM DGT) DIRECTORATE GENERAL OF TAXES.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.