Loading

Get Rent Rebate Application 2020 Colorado

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rent Rebate Application 2020 Colorado online

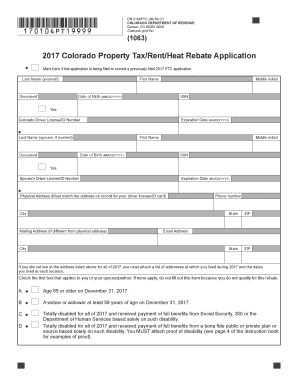

Filling out the Rent Rebate Application 2020 provides financial relief for eligible individuals in Colorado. This guide will walk you through the process of completing the application online, ensuring that you provide all necessary information accurately and efficiently.

Follow the steps to successfully complete your application.

- Click the ‘Get Form’ button to obtain the Rent Rebate Application 2020 and open it in your chosen editor.

- In the first section, enter your last name, first name, middle initial, date of birth, and Social Security number. Ensure all information is accurate.

- Next, provide your Colorado Driver License or ID number along with its expiration date. If applicable, repeat for your spouse or partner.

- Enter your physical address, making sure it matches the address on record for your driver license or ID. If your mailing address differs, include that as well.

- If you did not reside at the provided address for the entire year of 2017, attach a list of addresses and the corresponding dates of residency.

- Select the appropriate checkbox that applies to you or your spouse/partner regarding eligibility based on age or disability status.

- Fill in your total income received during the year from the categories listed (e.g., Social Security, wages, and other sources). Enter only the total amounts, not monthly figures.

- Record any property tax, rent, and heat expenses. Specifically list the amounts paid for rent and heating, ensuring you indicate if those were included in rent terms.

- Complete any direct deposit information, if applicable, including routing and account numbers.

- Sign and date the application, confirming that all provided information is accurate. If filing jointly, ensure both you and your spouse or partner sign as well.

- Finalize your application by reviewing all entries for accuracy. Download or print the completed form for your records. Once verified, share it via mail to the Colorado Department of Revenue.

Start filling out your Rent Rebate Application 2020 Colorado online today for potential financial relief.

Property Tax/Rent Rebate Program claimants now have the option to submit program applications online with the Department of Revenue's myPATH system. Filing online leads to fast processing, easy direct deposit options and automatic calculators that will help you apply for your rebate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.