Loading

Get 2022 Form 3581 Tax Deposit Refund And Transfer Request. 2022 Form 3581 Tax Deposit Refund And

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2022 Form 3581 Tax Deposit Refund And Transfer Request online

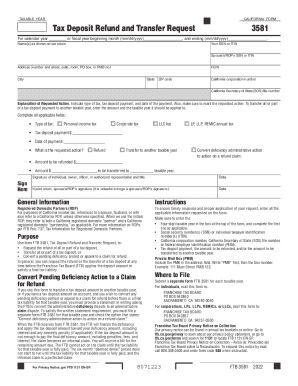

The 2022 Form 3581 Tax Deposit Refund And Transfer Request allows users to request refunds or transfers of tax deposit payments. This guide provides a step-by-step process to ensure accurate and complete form submission.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to retrieve the form and open it in your viewer.

- Indicate the taxable year at the top of the form by entering the four-digit year, along with the starting and ending months in the specified format.

- Provide your name(s) as shown on your tax return along with your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). If applicable, include your spouse’s or Registered Domestic Partner’s (RDP's) SSN or ITIN.

- Enter your complete address, including suite, room number, or Private Mail Box (PMB) as required.

- If applicable, include your California Corporation Number, California Secretary of State (SOS) File Number, or Federal Employer Identification Number (FEIN).

- In the 'Explanation of Requested Action' section, specify the type of tax: Personal Income Tax, Corporate Tax, LLC Fee, or LP, LLP, REMIC Annual Tax.

- Enter the amount of the tax deposit payment and the date of payment.

- Select the requested action by checking the appropriate box: Refund, Transfer to Another Taxable Year, or Convert Deficiency Administrative Action to Action on a Refund Claim.

- If requesting a refund, specify the amount to be refunded and if transferring, indicate the amount to be transferred to the taxable year.

- Sign the form where indicated, including the signature of the individual, owner, officer, or authorized representative. If this is a joint return, ensure your spouse’s or RDP's signature is also included.

- Finally, save your changes, and choose to download, print, or share the form as needed.

Complete your form online today to ensure your tax deposit requests are processed promptly.

Use form FTB 3581, Tax Deposit Refund and Transfer Request, to: • Request the refund of all or part of a tax deposit, • Transfer all or part of a tax deposit, or • Convert a pending defciency protest or appeal to a claim for refund.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.