Loading

Get Mo Dor Mo-nri 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO DoR MO-NRI online

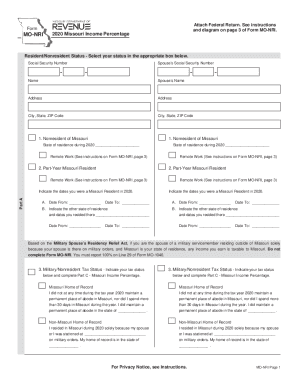

Navigating the MO DoR MO-NRI form can be straightforward with the right guidance. This guide provides step-by-step instructions to assist users in accurately completing the form online, ensuring compliance with Missouri tax regulations.

Follow the steps to fill out the MO DoR MO-NRI form effectively.

- Click ‘Get Form’ button to access the MO DoR MO-NRI form and open it in the editor.

- Select your resident or nonresident status for the year 2020 by checking the appropriate box provided. If you were a part-year resident, indicate the dates you were a resident of Missouri.

- Fill in the Social Security Numbers for yourself and your spouse, if applicable. Ensure that all names and addresses are filled in correctly.

- If applicable, indicate remote work status by checking the corresponding box. This is relevant if you performed work for a Missouri employer outside of Missouri.

- Complete Part B, which focuses on Missouri source income. Fill in all relevant lines based on your federal tax forms.

- In Part C, enter the calculation of your Missouri income percentage. This requires dividing your Missouri income by your total adjusted gross income.

- Sign and date the form at the end, ensuring to include your spouse’s signature if filing a combined return.

- Once completed, save your changes. You may choose to download, print, or share the form as needed.

Complete your documents online to ensure accurate and timely filing.

If your employee is a resident of a state with whom Illinois does not have a reciprocal agreement (i.e., Missouri), you must withhold Illinois income tax on all income that is paid in Illinois. You may be required to withhold tax for another state in which the employee works or resides.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.