Loading

Get St108nr

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ST-108NR online

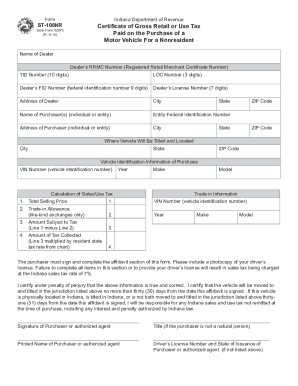

The ST-108NR is a critical form for individuals purchasing motor vehicles in Indiana as nonresidents. This guide provides detailed, step-by-step instructions on how to complete the ST-108NR online, ensuring accuracy and compliance with state regulations.

Follow the steps to effectively complete the ST-108NR online.

- Press the ‘Get Form’ button to obtain the ST-108NR form and open it in the online editor.

- Begin by entering the name of the dealer as listed on their Registered Retail Merchant Certificate to identify the seller.

- Fill in the dealer’s RRMC number, which includes a 10-digit TID number followed by a 3-digit LOC number; ensure this follows the proper format.

- Input the dealer’s FID number, ensuring it is a 9-digit federal identification number.

- Provide the dealer's 7-digit license number as required.

- Enter the dealer's complete address, including city, state, and ZIP code.

- List the name of the purchaser, which can be an individual or an entity, and include their federal identification number if applicable.

- Fill out the purchaser's address details accurately—city, state, and ZIP code.

- Specify where the vehicle will be titled and located by entering the city, state, and ZIP code.

- For the vehicle identification information, enter the VIN, year, make, and model of the vehicle being purchased.

- Calculate the total selling price, including all associated costs, excluding the federal excise tax.

- If applicable, indicate the trade-in allowance for like-kind vehicle exchanges along with the required details (make, model, year, VIN of trade-in).

- Determine the amount subject to tax by subtracting the trade-in allowance from the total selling price.

- Calculate the amount of tax collected using the appropriate resident state tax rate from the provided chart.

- Complete the signature section by ensuring the purchaser or an authorized agent signs the form, affirming that the vehicle will be moved out of Indiana.

- Lastly, save changes to the form, download a copy for your records, and if necessary, print or share the completed ST-108NR.

Complete your documents online to ensure a seamless process and compliance.

Use tax is complementary to Indiana sales tax, and is due on property acquired for use, storage or consumption in Indiana if Indiana sales tax is not paid to the seller at the time of purchase.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.