Loading

Get Gsa 5025 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GSA 5025 online

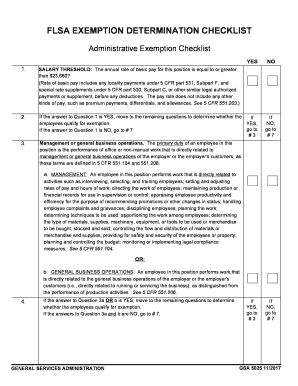

Filling out the GSA 5025 form is essential for determining the administrative exemption status under the Fair Labor Standards Act (FLSA). This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to fill out the GSA 5025 form correctly.

- Click the ‘Get Form’ button to obtain the form and open it for editing.

- Review the salary threshold question. Ensure the annual rate of basic pay for the position is equal to or greater than $23,660. If the answer is 'YES', proceed to the next questions; if 'NO', go to question 7.

- Evaluate the primary duty of the employee. Determine if it involves management or general business operations by selecting 'YES' for either option a or b. If both are 'NO', proceed to question 7.

- Assess whether the position requires discretion and independent judgment regarding matters of significance. If 'YES', continue; if 'NO', go to question 7.

- Confirm that the primary duty involves spending more than 50% of work time on the specified functions. If 'YES', you are prepared to classify the employee as exempt; if 'NO', proceed to question 7.

- Finalize your determination. If you have answered 'YES' to all relevant questions, indicate that the employee is exempt. If any 'NO' was answered, mark the employee as non-exempt.

- Once completed, ensure to save changes, and download, print, or share the form as necessary.

Begin filling out the GSA 5025 form online today to ensure accurate exemption determination.

Related links form

The term “matters of significance” refers to the level of importance or consequence of the work performed. (b) The phrase “discretion and independent judgment” must be applied in the light of all the facts involved in the particular employment situation in which the question arises.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.