Loading

Get Wi F-00107 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI F-00107 online

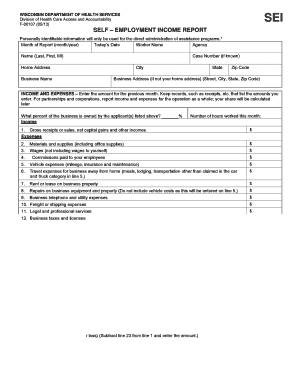

Filling out the WI F-00107 form is essential for reporting self-employment income. This guide provides clear, step-by-step instructions to assist you with completing the form accurately online.

Follow the steps to complete the WI F-00107 form effectively.

- Click the ‘Get Form’ button to access and open the WI F-00107 form in the online editor.

- Enter the month of the report and today's date in the designated fields. These details are essential for the accuracy of your submission.

- Provide your worker name and agency along with your full name in the section specified for personal identification. Make sure to format your name as Last, First, MI.

- Input your case number if known, followed by your home address including city, state, and zip code.

- If your business address is different from your home address, fill out that information in the corresponding fields.

- Report your income and expenses for the previous month by entering the relevant amounts in the designated sections. Keep records, such as receipts, to support these entries.

- Indicate what percentage of the business is owned by you or any other applicants listed above.

- Specify the number of hours you worked during the month. This information helps assess your business's financial situation.

- List the gross receipts or sales, net capital gains, and any other income in the income section.

- Complete the expense section by entering the amounts for specific categories such as materials and supplies, wages, vehicle expenses, travel expenses, rent, repairs, utilities, and others as prompted.

- Total all your expenses to find the total expenses, then calculate your net business income (or loss) by subtracting the total expenses from the gross income.

- Once you have filled out all sections, review your entries for accuracy, then provide your signature and date to certify the information is true to the best of your knowledge.

- Finally, you can save your changes, download, print, or share the completed form as needed.

Start completing your WI F-00107 form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To report self-employment income, complete IRS Form 1040 Schedule C, and ensure you keep detailed records of your earnings and expenses. Additionally, include the WI F-00107 form when filing your Wisconsin state taxes to meet local requirements. Following these procedures maintains compliance with tax laws and helps you avoid unnecessary penalties.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.