Loading

Get Uk Hmrc Starter Checklist 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC Starter Checklist online

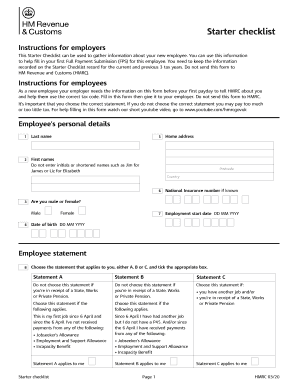

The UK HMRC Starter Checklist is an essential document used by employers to collect important information about new employees. This guide provides clear, step-by-step instructions on how to fill out the form accurately and effectively.

Follow the steps to complete the UK HMRC Starter Checklist.

- Press the ‘Get Form’ button to access the UK HMRC Starter Checklist and open it for further editing.

- Begin by entering your personal details in the designated fields. Provide your last name, first names (avoid initials), home address, postcode, country, and National Insurance number if known.

- Input your employment start date in the format DD MM YYYY. Indicate your gender by selecting either male or female.

- Provide your date of birth in the format DD MM YYYY.

- Choose the appropriate statement that applies to you from Statements A, B, or C. Ensure to check the box corresponding to your selection.

- If applicable, answer questions regarding any existing Student Loans. Indicate if you have a Student Loan that is not fully repaid and identify the type of loan.

- Conclude by filling in the declaration. Confirm the accuracy of the information you've provided by entering your signature, full name, and the date in the format DD MM YYYY.

- Once you have completed all sections of the form, you can save your changes, download, print, or share the completed document as needed.

Complete your UK HMRC Starter Checklist online today and ensure a smooth onboarding process for new employees.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You only need a starter checklist from your employee to work out their tax code if they do not have a P45, or if they left their last job before 6 April 2019.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.