Loading

Get Ny It-360.1-i 2024-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-360.1-I online

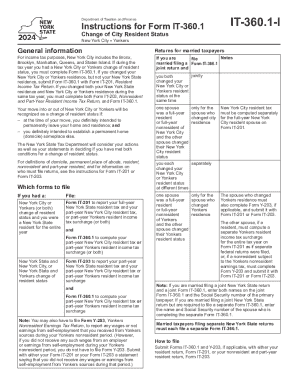

The NY IT-360.1-I is a vital form for individuals who have changed their city residency status in New York. This guide provides step-by-step instructions to ensure you complete the form accurately and efficiently online.

Follow the steps to successfully complete your NY IT-360.1-I online.

- Press the 'Get Form' button to obtain the form and open it in the editor.

- Enter your name and Social Security number as they appear on your Form IT-201 or Form IT-203. Include your spouse's information if applicable.

- If applicable, mark the appropriate box indicating your change of residence status, whether it's for Yonkers or New York City.

- Complete Part 1 by entering your New York adjusted gross income and detailing the periods you were a New York City resident and Yonkers resident.

- Proceed to Part 2 to fill out your itemized deductions if you itemized them on Form IT-201 or IT-203.

- In Part 3, provide the necessary information regarding dependent exemptions based on your residency period.

- Complete Part 4 to compute your part-year New York City resident tax, using the provided tax brackets based on your income.

- If applicable, fill out Part 5 to compute your part-year Yonkers resident income tax surcharge.

- Review all entered information for accuracy, then save your changes, download the completed form, or print it for submission.

Complete your NY IT-360.1-I form online today for a smooth filing experience.

Related links form

The most straightforward way to avoid NYC city tax is by ensuring you are not considered a resident of the city. NYC residents are subject to local income tax, which can range from 3.078% to 3.876%. To avoid NYC city tax, you must establish residency outside of the city.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.