Loading

Get In Dor Np-20 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN DoR NP-20 online

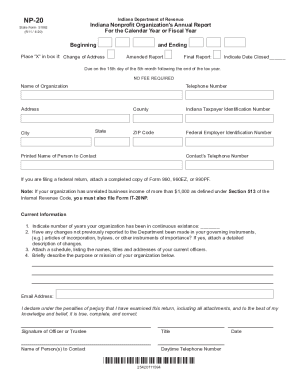

Completing the Indiana Nonprofit Organization's Annual Report, known as the IN DoR NP-20, is an essential task for nonprofit organizations operating in Indiana. This guide provides clear, step-by-step instructions to help users successfully fill out the form online.

Follow the steps to complete the NP-20 form accurately.

- Click the ‘Get Form’ button to obtain the IN DoR NP-20 form and open it in your preferred online editing tool.

- Begin by entering the name of your organization in the designated field. Ensure that the name matches the official name registered with the state.

- Fill in your organization’s telephone number and address, including city, state, county, and ZIP code. Accurate contact information is essential for effective communication.

- Provide your Indiana Taxpayer Identification Number and Federal Employer Identification Number in the specified fields.

- Check the appropriate boxes if your organization has changed its address, is submitting an amended report, or has filed a final report. If the organization has closed, indicate the date closed.

- Report the number of years your organization has been in continuous existence. This information helps maintain accurate records.

- If there have been any changes not previously reported to the Department regarding your governing instruments, indicate this and attach a detailed description of those changes.

- Attach a schedule that lists the names, titles, and addresses of your current officers, ensuring that all information is up-to-date.

- Briefly describe the purpose or mission of your organization in the space provided. This summary helps to clarify the objectives of your nonprofit.

- Fill in the email address for contact purposes, followed by the declaration statement. An officer or trustee must sign and date the form, confirming the accuracy of the submitted information.

- Review all information entered for accuracy. Once completed, save any changes, and consider downloading, printing, or sharing the form as needed.

Complete your IN DoR NP-20 form online today to ensure your nonprofit maintains compliance with state regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Choose your Indiana nonprofit filing option. File IN nonprofit articles of incorporation. Get a Federal EIN from the IRS. Adopt your nonprofit's bylaws. Apply for federal and/or state tax exemptions. Register for required state licenses. Open a bank account for your IN nonprofit.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.